Following the financial bombshell of Dollar General, another American discount retail giant specializing in the down-market, Dollar Tree, has also raised a red flag for the weakening consumption of the middle and low-income population, slashing its full-year profit guidance beyond expectations.

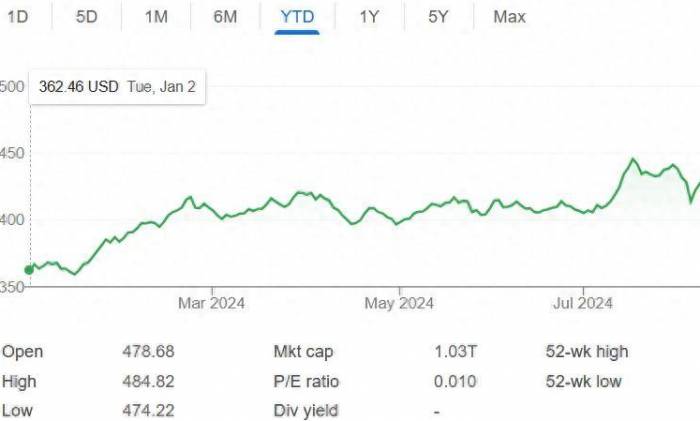

On Wednesday, September 4, Eastern Time, Dollar Tree announced its financial data for the second quarter (hereinafter referred to as Q2) of the fiscal year 2024 (hereinafter referred to as the full year), which ended on August 31, 2024, and provided performance guidance for the fiscal year 2024.

1) Main financial data:

- Revenue: Q2 net sales were $7.37 billion, a year-on-year increase of 0.7%, while analysts expected $7.49 billion.

- EPS: Q2 adjusted earnings per share (EPS) were $0.67, a year-on-year decrease of 26.4%, while analysts expected an increase of 1.05%.

- Same-store sales: Q2 overall same-store sales growth was 0.7%, while analysts expected a growth of 1.45%, and a year ago it was 6.9%. Specifically, Q2 same-store sales for the Dollar Tree business grew by 1.3%, while analysts expected a growth of 2.89%, and a year ago it was 6.9%. Q2 same-store sales for the Family Dollar business decreased by 0.1%, while analysts expected a decrease of 0.21%.

- Gross margin: Q2 overall gross margin was 30%, while analysts expected 29.9%, and a year ago it was 29.2%. Specifically, Q2 gross margin for the Dollar Tree business was 34.2%, while analysts expected 34.1%, and a year ago it was 33.4%. Q2 gross margin for the Family Dollar business was 24.9%, while analysts expected 24.6%.

- Stores: As of Q2, the total number of stores was 16,388, a year-on-year decrease of 0.5%, while analysts expected 16,374. Specifically, there were 8,627 Dollar Tree stores, a year-on-year increase of 5.5%, while analysts expected 8,294. There were 7,761 Family Dollar stores, a year-on-year decrease of 6.5%, while analysts expected 8,071.

2) Full-year performance guidance:

- Revenue: Full-year net sales are expected to be between $30.6 billion and $30.9 billion, previously expected to be between $31 billion and $32 billion.EPS: Adjusted full-year EPS is projected to be between $5.2 and $5.6, down from the previous expectation of $6.5 to $7.0, and below the analyst consensus of $6.57.

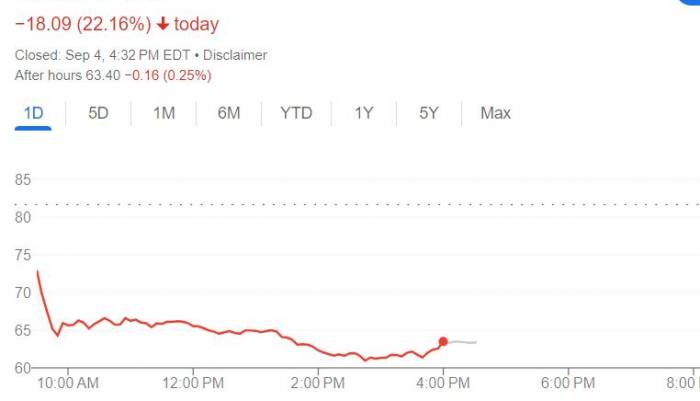

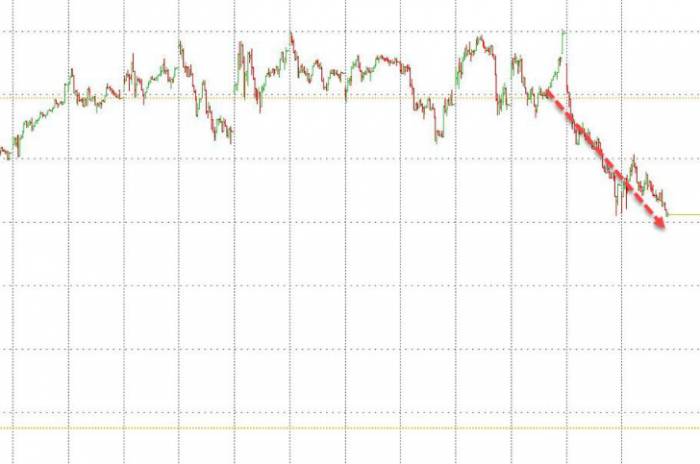

Following the earnings report, Dollar Tree's stock price gapped down nearly 11% on Wednesday, with losses exceeding 20% in the morning session. The decline remained above 20% in the afternoon, hitting a daily low with a drop of 25.5%, and closed down nearly 22.2%.

Weak demand is not limited to low-income households; macro pressures are increasingly affecting the shopping behavior of middle and high-income customers.

In the second quarter, Dollar Tree's revenue saw a slight increase, thanks to a 1.1% rise in customer traffic during the period, but the average transaction value fell by 0.5%. This indicates that although more customers were shopping, their spending decreased, which still could not significantly drive the company's revenue growth.

The prospect of sluggish consumer spending is further reflected in Dollar Tree's performance guidance. Dollar has reduced its full-year sales guidance by about 1.3% to 3.4%, and the entire EPS guidance range has been significantly lowered by 20%. The new EPS guidance is well below Wall Street expectations, with the lower end of the guidance range nearly 21% below analyst expectations and the upper end nearly 15% lower. A Goldman Sachs analyst commented that although they anticipated Dollar Tree would lower its EPS guidance, they did not expect such a significant reduction, noting that the company mentioned that consumer weakness has reached middle and high-income customers.

Chief Financial Officer (CFO) Jeff Davis stated in a statement that the main reason for the reduction in full-year sales guidance is the increasing impact of "macro pressures on the purchasing behavior of middle and high-income customers at Dollar Tree."

In the performance call, Davis reiterated this point, saying that the company's sales are weaker, especially in the sales of non-essential consumer goods, which "reflects the increasing impact of macro pressures on the purchasing behavior of middle and high-income customers at Dollar Tree."

He also said, "Our initial second-quarter expectations did not anticipate that these pressures would shift so severely to Dollar Tree's customer base."

Comments have pointed out that Dollar Tree's performance provides a unique window into the health of American consumer spending, as its namesake Dollar Tree stores cater to suburban middle and high-income consumers, while its Family Dollar chain stores primarily serve low-income families purchasing essential goods. Over the past few quarters, the core low-income customer base of Family Dollar has consistently shown weak demand. Now, this weakness appears to have spread to the relatively affluent customer base that frequents Dollar Tree.Dollar Tree also mentioned this shift in consumer behavior when announcing its financial results, stating that families with an annual income of over $125,000 have begun to transition from "buying what they want" to "buying what they need," with a significant shift in the sales mix towards essential items for these households.

Mike Creedon, Chief Operating Officer of Dollar Tree, said, "People may have changed the way they celebrate parties this summer. There were fewer guests and fewer parties."

When Dollar Tree released its financial report, it stated that it is "experiencing one of the most challenging macro environments in history." This sentiment is likely shared by its arch-rival Dollar General, which announced its financial results last week.

As Wall Street Journal reported, Dollar General's second-quarter results, announced last Thursday, fell short of expectations across the board, and it lowered its full-year EPS guidance range by nearly 18% to 19%. The CEO of Dollar General attributed the trend of weak sales partly to the financial pressures on its core customers. Analysts believe that Dollar General's poor performance at least indicates that the downward trend in U.S. consumer spending is still ongoing and may worsen in the coming months.

Leave a Comment