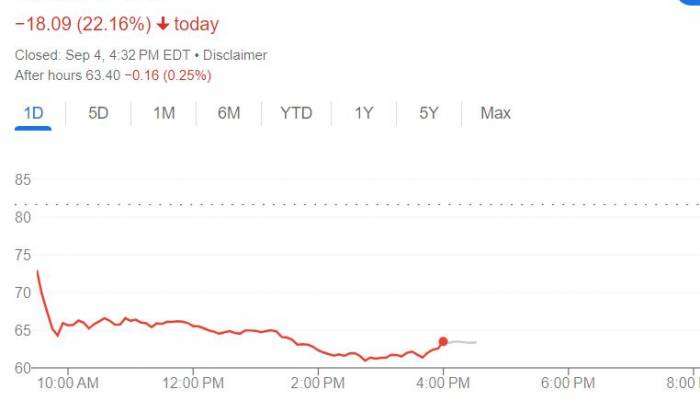

Nvidia, the AI industry leader, suffered a significant plunge on Tuesday, with its market value evaporating a record $279 billion. Media reports suggest that the sharp decline has traders anxiously searching for the next support level.

Jay Woods, Global Chief Strategist at Freedom Capital Markets, believes that $100 is a key level for Nvidia's stock price, which is around the level of the lowest closing price last month. Nvidia's stock opened down 3.3% on Wednesday but then turned positive, rising 1.38% to $109.48.

Woods stated:

"I don't want to see the stock make new lows; if it breaks the August lows, that will really indicate that, at least from a technical perspective, things have changed. I think the stock will find support around $100 and then consolidate for a while."

Nvidia had fallen 16% in the four trading days leading up to Wednesday, primarily due to the chipmaker's earnings failing to meet excessively high expectations. Additionally, investor anxiety was exacerbated by two research reports released on Tuesday, which warned about corporate spending on artificial intelligence. More bad news came after Tuesday's close, with media reports that Nvidia had received a subpoena from the U.S. Department of Justice's antitrust investigation.

Michael Kirkbride, Portfolio Manager at Evercore Wealth Management, said the issue with Nvidia's stock is the lack of events that could bring positive momentum in the foreseeable future.

He said:

"We're in a bit of a void right now; the earnings season is over, and there will be a lot of economic data released this month. There's a lot of caution around that. When you're in a trading vacuum, the market becomes very short-term, turning into a preemptive selling market."

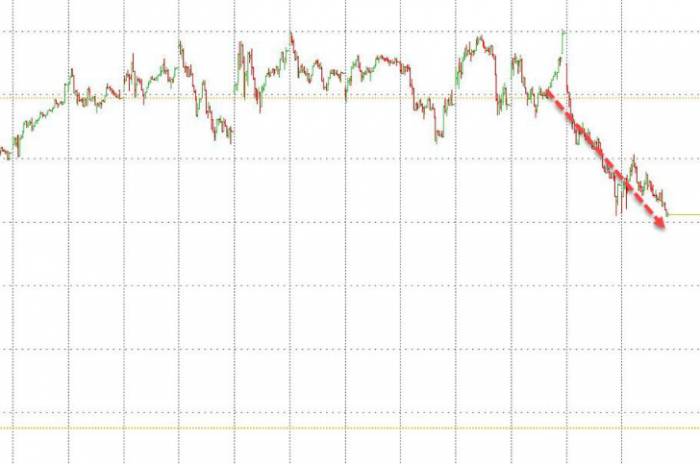

After several months of turbulence, Nvidia's sharp decline has dragged down global chipmakers and risky assets. Tuesday's drop was the seventh time in two months that the stock fell more than 6%. Data shows that the 30-day volatility of Nvidia's stock has also reached its highest level since mid-2022.

Investors are reviewing Nvidia's performance last month, looking for a possible bottom. In August, Nvidia experienced a correction, with the stock falling 27% from its peak in June, then rebounding to within 5% of its all-time high. At the time, the decline was attributed to macroeconomic concerns and persistent questions about massive spending on artificial intelligence, a concern that has resurfaced today.On Tuesday, a research report released by J.P. Morgan Asset Management and the BlackRock Investment Institute focused on the issue that Nvidia's largest customer received relatively small returns after investing tens of billions of dollars. Michael Cembalest, Chairman of Market and Investment Strategy at J.P. Morgan, stated that within the next 12 to 18 months, Nvidia needs to demonstrate broader demand from enterprise customers, rather than just customer demand for spending on training new models like OpenAI, in order to justify the massive expenditure on AI technology.

Meanwhile, Jean Boivin, who leads the BlackRock Investment Institute, indicated that the construction of data centers and the enhancement of processing capabilities typically require "years, not quarters," thus investors need to be patient. However, Boivin suggested that investors should continue to overweight AI stocks, as the recent sell-off in the technology sector "implies space for re-establishing positions."

Woods from Freedom Capital and Kirkbride from Evercore WM also maintain an optimistic attitude towards Nvidia's long-term prospects. Woods believes that there is no reason to panic about this week's downturn, while Kirkbride stated that there are no issues with the company's fundamentals or earnings reports.

Kirkbride said, "We remain long-term holders, not hearing any news that changes the story, whether about Nvidia or its customers and their spending plans. We would buy now."

Although Nvidia ranks only third in the S&P 500 index with a weight of 6.1%, it has become a major driver of this benchmark this year. Since January of this year, the chipmaker's stock price has been dominating the broader market trend, and this week's plunge does not bode well for the outlook of the S&P 500 index.

Leave a Comment