"The lowest point of the A-share index may have already passed," this judgment comes from two "axioms," and some market observations are illustrating that these two "axioms" have occurred.

I. Axiom One: Low trading volume indicates low prices

At the level of securities trading, the low points of stock turnover rates often coincide with the low points of stock prices. Some arguments suggest that the lowest turnover rate of A-shares has already passed, in other words, the low point of stock prices has already passed.

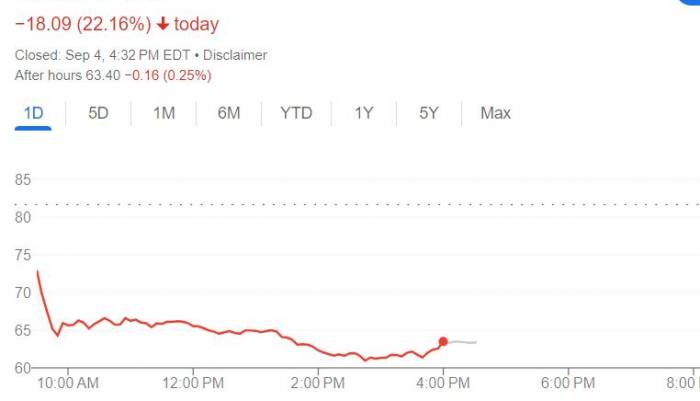

1. The turnover rate of A-shares has previously fallen to the level of the fourth quarter of 2018, a typical low point level of a bear market.

Recently, the low point of the total A-share transaction amount was about 480 billion yuan, with a turnover rate (total A-share transaction amount / free float market value) of about 1.5%. In the fourth quarter of 2018, both stocks and bonds suffered, with the low point of the turnover rate at about 1.1%, and the average low point of the turnover rate (30-day moving average) was around 1.5%. In this light, the current turnover rate is close to the 2018 low point, which should be considered as having experienced a low trading volume.

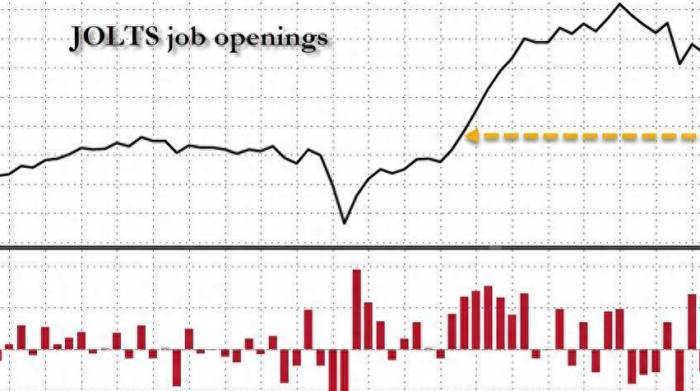

2. The trend of credit spreads in the bond market can corroborate that the A-share turnover rate has passed its lowest point.

We observe that there is a correlation between the low points of bond credit spreads and the low points of stock market turnover rates. Generally speaking, the stock turnover rate will enter a low point around the time when bond credit spreads bottom out. When a large amount of capital shifts from stocks to bonds, the trading of credit bonds becomes very crowded, and credit spreads are continuously compressed. When the compression of credit spreads reaches an extreme, it also means that the liquidity of the stock market has reached a low point. If the credit spread begins to widen, the transaction volume of the stock market will also increase, such as in May 2020 and October 2022.

Currently, looking at the credit spreads, the liquidity spread has widened, and the grade spread has narrowed to an historical extreme, indicating that the bond credit spread has widened, and a large amount of capital is no longer accumulating in bonds, and the stock market transaction volume may slowly increase.

II. Axiom Two: Stock prices lead earnings

The securities market prices stocks based on expectations, and the low points of stock prices often precede the low points of corporate earnings. If we are experiencing the lowest point of corporate earnings, then the low point of stock prices may have already passed.Corporate revenue is the most important indicator for observing profitability, bar none. This is because main business income is the most difficult to manipulate and is the most credible accounting metric, while accounting profits can often be distorted by various factors.

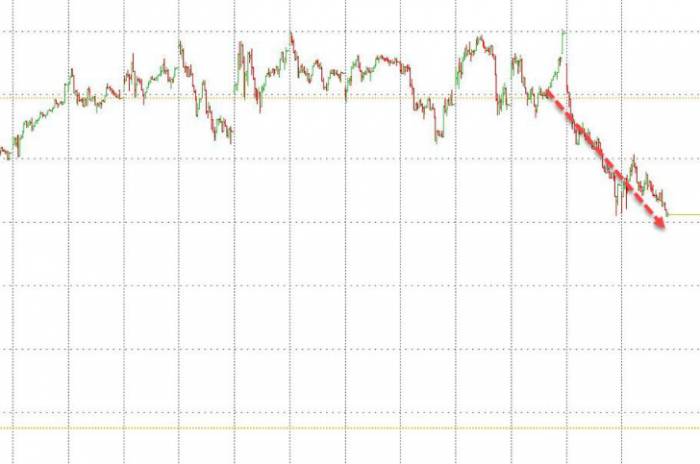

1. The year-on-year growth rate of listed company revenues in the second quarter of 2024 (for all A-shares/excluding financials, oil, and petrochemicals) has created the fourth lowest point in the past two decades.

Generally speaking, a continuous decline in revenue (i.e., a continuous negative year-on-year growth rate) in A-shares history does not exceed three quarters.

2. The lowest point of stock indices generally appears before the lowest point of corporate revenue growth rates.

3. There is no significant relationship between the low points of corporate revenue growth rates and GDP growth rates.

The actual GDP year-on-year growth rates corresponding to the low points of all A-share revenue growth rates (2009Q1, 2015Q3, 2020Q1) were positive 6.4% (2009Q1), 7.0% (2015Q3), and negative -6.9% (2020Q1). Therefore, investors can appropriately pay less attention to so-called macroeconomic indicators.

We boldly speculate that the year-on-year growth rate of listed company revenues in the third quarter of 2024 may be the lowest point of this cycle, and it may still be negative. However, starting from the fourth quarter of 2024, the year-on-year revenue growth rate begins to rise. That is to say, we are currently experiencing the lowest point of corporate profitability, and the lowest point of stock prices has already passed.

Leave a Comment