I. Market Review

As of the close, the Shanghai Composite Index fell by 0.67%, the Shenzhen Component Index fell by 0.51%, the ChiNext Index fell by 0.11%, the North Index 50 fell by 1.38%, and the STAR Market fell by 0.4%. In terms of sector themes, the pharmaceutical commerce, solid-state battery, insurance, and education sectors led the gains, while the ST sector and consumer electronics concept led the declines. The Shanghai and Shenzhen markets traded a total of 559.4 billion yuan, with financing selling out 4.58 billion yuan yesterday.

II. Market Analysis

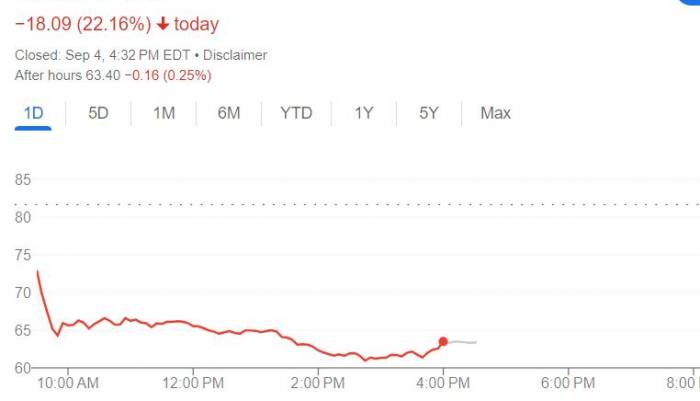

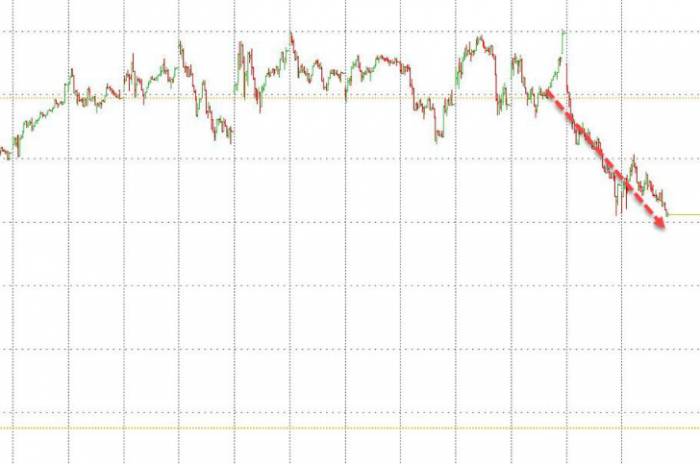

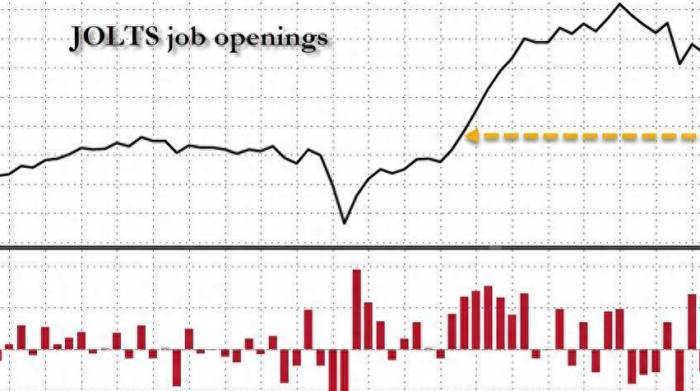

The Bank of Japan's governor reiterated on Tuesday (September 3rd) that if the economic and price performance aligns with the bank's expectations, the Bank of Japan will continue to raise interest rates. This led to a significant drop in the Japanese stock market today, which in turn dragged down the Asia-Pacific stock markets.

Although we did not anticipate that today's decline was due to the Bank of Japan's stance, we also mentioned yesterday that there might be a short-term possibility of following the second scenario we discussed, and indeed, there are signs of this in today's market.

If the market sees two large volume bearish candles in the next two days, it is very likely that there will be a rapid rebound to the range above 2,850 points in the short term.So, at this current level, there is no need for excessive panic. The position of A-shares is fundamentally different from the stock markets of Japan, South Korea, and Taiwan, China, as they are all at high levels. The reason why the index has behaved this way today is mainly due to the selling pressure from the two major oil companies, which had significant gains in the early period, while securities firms and insurance companies are clearly supporting the market.

At present, the most important thing is patience and confidence. Against the backdrop of a sharp drop in the stock markets of Asia-Pacific and even Europe and America, if A-shares can withstand this external impact, then victory is in sight!

III. There is a way to make money

Consumer electronics have been hit today, but they have closed with a small lower shadow line, which is still relatively strong. We continue to be optimistic about this direction, and the virtual reality sector is also performing similarly; we still have a positive outlook for these two directions.

Insurance has been on a continuous rise for several days, and after encountering short-term pressure from the annual line, it may fluctuate and digest for a while. The securities sector is in a similar position to the insurance sector and will take over to support the market later.

In the past two days, when the index has not yet fully stabilized, sector rotation has been very fast. However, some heavyweight stocks will still support the index, which is also a shift in capital from high to low.

It is not recommended to chase gains and cuts every day. If the direction is unclear, it is better to observe first. If you have a medium-term optimistic view of a direction, believe that the current cost-performance ratio of A-shares is already very high, and just need to hold the stocks patiently.

Leave a Comment