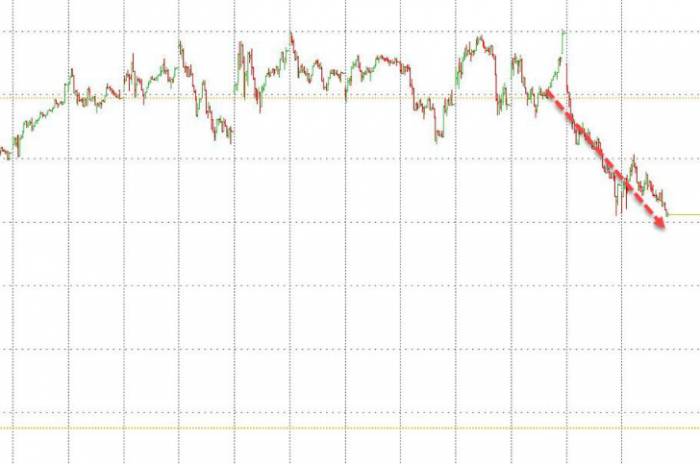

Overnight, Nvidia's stock plummeted, triggering a sell-off in chip stocks, and a new wave of market panic seems to be sweeping back.

As September starts on a "black" note, some traders are also pondering whether this is a good time for a "bottom-fishing" opportunity? For investors who have enjoyed the substantial gains from chip stocks in the past few years, this is a critical moment.

Some analysts believe that every sell-off is an opportunity to buy, and concerns about the AI demand outlook are exaggerated. Other analysts point out that the stock market's "September curse" combined with the upcoming non-farm payroll data makes the market extremely unstable, and some traders will not take risks for the time being.

Nvidia's plunge raises concerns, is "buying on dips" feasible?

Overnight, Nvidia's stock plummeted by 9.5%, with a market value loss of 279 billion yuan, setting a record for the largest single-day market value drop in history. Since releasing its financial report last week, Nvidia's stock price has fallen by more than 14%, and the company's performance often sets the tone for the chip and AI industries. Under the impact of Nvidia, chip AI stocks such as SK Hynix, Tokyo Electron, and TSMC have seen widespread declines.

Analysis points out that Nvidia's plunge this time is due to the market's concerns about its financial report, believing that the company is overvalued and the guidance for revenue growth is slowing down. To make matters worse, Nvidia received a subpoena from the U.S. Department of Justice, increasing the risk of antitrust regulatory scrutiny. At the same time, weak chip sales data also dampens the industry outlook. UBS analyst Timothy Arcuri analyzed that chip sales fell by 11.1% in June-July.

Panic spreads, and the panic index VIX surged on Tuesday, with ongoing concerns about high market volatility. The current "September curse" is hard to shake, and over the past century, September is the only month with a negative average return rate for U.S. stocks. Moreover, the U.S. non-farm employment report is about to be released this Friday, which may cause a significant market shock.

Some traders choose to act cautiously. Charu Chanana, Head of Currency Strategy in Singapore, said:

The "curse" of September, coupled with the memory of the plunge after the employment data in early August, and the upcoming release of another (non-farm) employment report, traders will not take risks at the moment. I will also be quite cautious.

UBS Global Asset Management analysts, on the other hand, stated that some investors have begun to question whether the investment returns on tech stocks like Nvidia can be realized:Investors are now beginning to question whether the promised returns on investment can be realized. When they observe certain macroeconomic data that is not as robust, they become somewhat anxious. Thus, a question arises: whether to continue the music and dance, and if the enthusiasm for investment in cloud computing is still there.

However, there are still many voices in support of NVIDIA and AI chip stocks, who believe that this is a good time to bottom-fish. Jung In Yun, CEO of Singapore-based Fibonacci Asset Management, said:

"Although we anticipate that the stock market will experience a peak in volatility in the coming period, we still believe that every sell-off is an opportunity to buy. We expect the Asian (chip) stock market to rise rapidly again. We think concerns about AI demand peaking are exaggerated, and the demand for AI and industry infrastructure is very likely to remain strong in the first half of next year."

He added that investors should "look for stocks related to artificial intelligence that have not yet experienced significant increases."

After NVIDIA's sell-off, Wedbush Securities analyst Daniel Ives came forward to support NVIDIA:

"Stepping back, NVIDIA has transformed technology and the global landscape because its (GPU) has become the new oil and new gold in the IT sector. Its chips have driven the AI revolution and are currently the only choice."

Piper Sandler institutional analyst Harsh Kumar acknowledged that NVIDIA's earnings report did not fully meet investors' expectations, but he remains bullish on NVIDIA. He pointed out that there is strong market demand for NVIDIA's Hopper chips, which are expected to grow further in the second half of the fiscal year. At the same time, the revenue from the Blackwell chips is essentially on track.

Leave a Comment