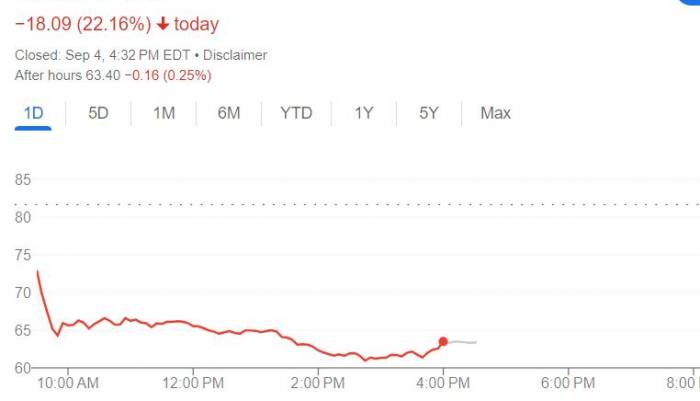

Due to the continued contraction of the US August ISM Manufacturing Index, which fell short of expectations, concerns about a recession have once again heated up, with traders fully pricing in rate cuts, leading to a surge in US Treasury bonds.

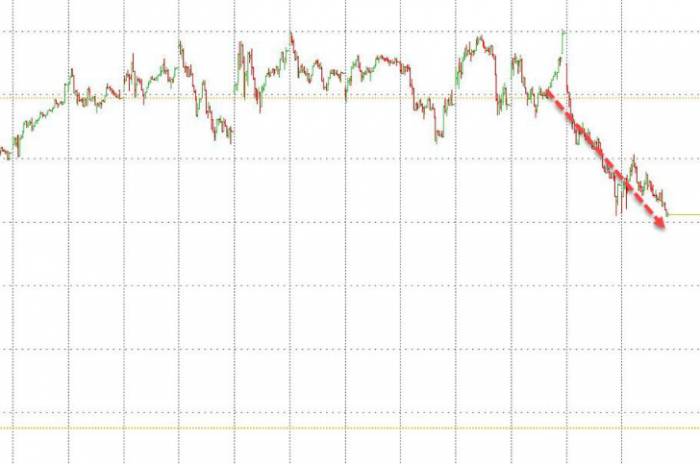

On Tuesday, US Treasury yields plummeted across the board, with the 2-year Treasury yield falling as much as 7 basis points during the session. The 2-year Treasury has now achieved four consecutive months of gains, setting a record for the longest winning streak since 2021. Since the end of April, propelled by expectations of rate cuts, the overall return on US Treasuries has exceeded 6%.

For bond bulls, if the labor market remains resilient, it will dampen expectations for the Federal Reserve to make significant rate cuts, making the upcoming non-farm payroll report on Friday a key focal point.

Ed Al-Hussainy, a rate strategist at Columbia Threadneedle Investments, said:

"If you missed the rally, it might be a bit risky to chase it now."

"The issue we are facing now is that the job market could either stabilize or deteriorate rapidly. This is the focal point of debate for the second half of this year."

Currently, economists generally expect the US non-farm payrolls for August to increase from 114,000 in the previous month to 165,000, with the unemployment rate falling by 0.1 percentage points from 4.3% to 4.2%, indicating a slight recovery in the labor market.

It is noteworthy that in the August ISM Manufacturing sub-index released overnight, the employment index showed a significant improvement. Analysts suggest that this may indicate that this Friday's non-farm payroll report will be stronger than expected.

Traders now anticipate that the Federal Reserve will cut rates by a full 100 basis points within the year, which means that in the remaining three FOMC meetings in 2024, at least one will involve a significant rate cut of 50 basis points.

However, the current labor market data is "mixed," with the latest data from the Conference Board showing that job positions are not "abundant," while the number of initial weekly unemployment benefit claims has remained stable over the past few months.Therefore, some viewpoints tend to believe that the bond rally will be somewhat weakened. Deutsche Bank strategists stated in a client report:

"Given that the NBER (National Bureau of Economic Research) seems unlikely to declare a recession in the next 3-4 months, a calm examination of the data shows that a rate cut of more than 200 basis points is hard to be considered reasonable."

"Economic development is relatively slow, and there is only a reason for the expected substantial rate cut if the market falls rapidly."

In addition, corporate bond issuance tends to increase after the summer, so bond yields in September will show a seasonal upward trend, which increases the supply pressure on the market.

Historical data also indicates that for bond investors, September has been the worst month in the past decade— the 10-year U.S. Treasury yield has risen in 8 out of the last 10 years, with an average increase of 18 basis points.

Leave a Comment