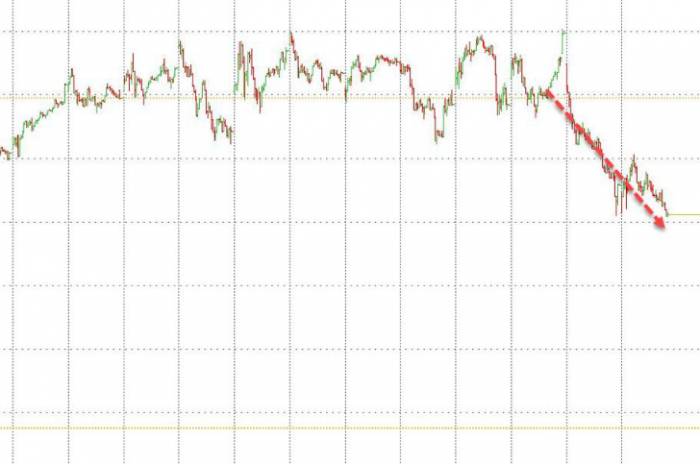

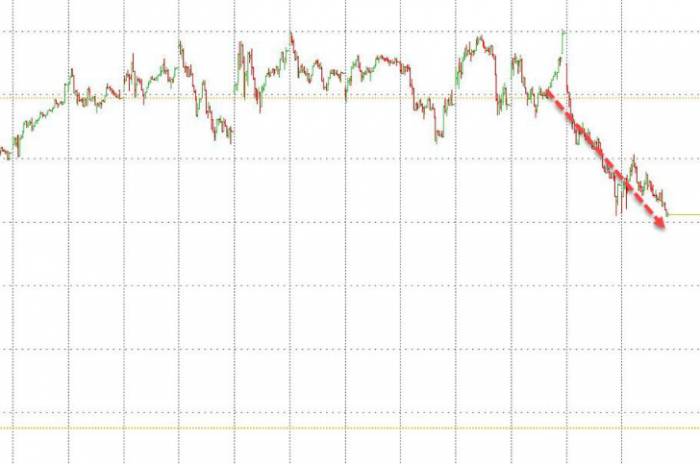

A month later, U.S. stocks were once again severely battered, with the first trading day of September, known as "Black Tuesday," seeing a notable decline in technology stocks. The Nasdaq fell by more than 3% on Tuesday of this week, with Nvidia experiencing a drop of 10.1% at one point. The Philadelphia Semiconductor Index, which tracks chip stocks, plummeted nearly 7.8%, marking the largest decline since the "Black Monday" on August 5th a month ago, and the second-largest drop of the year. The chip stock ETF, VanEck Semiconductor ETF (SMH), closed down 7.5%, the biggest drop since March 2020.

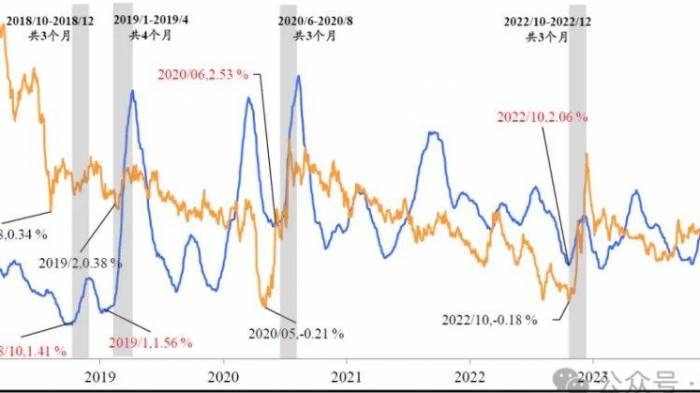

Wall Street Journal recently mentioned that for nearly a century, September has been the month with the worst average return rate for U.S. stocks. Data since 2018 shows that technology stocks also face a tough time in September.

From this perspective, it should be understandable why Goldman Sachs technology trader Peter Bartlett said that the plummet in the semiconductor industry is "by far the most asked question (by clients)." Unfortunately, Bartlett admitted that there is currently no satisfactory reason to explain why the start of September this year has been so poor. However, he mentioned that early feedback indicates that the sharp decline on Tuesday was due to the combined effect of the following factors:

As investors returned to the market after the U.S. Labor Day holiday, the remaining impact on Nvidia's stock investments related to earnings. The main resistance to the rise in Nvidia's stock after the release of its financial report last week was due to:

- The earnings per share (EPS) guidance for the second and third fiscal quarters being less than expected, with less surprise than in previous quarters, and the gross margin normalizing;

- Some high-end buyers' holdings actually decreased after Nvidia's earnings announcement;

- Positioning and technical aspects: Nvidia's stock fell by more than 7% after the earnings announcement, the largest drop since April, which obviously set the tone for an initial broader sell-off.

Attention should be paid to the negative seasonal effect on chip stocks, with semiconductor stocks having declined in September for four consecutive years, with an average monthly drop of 4.6%.

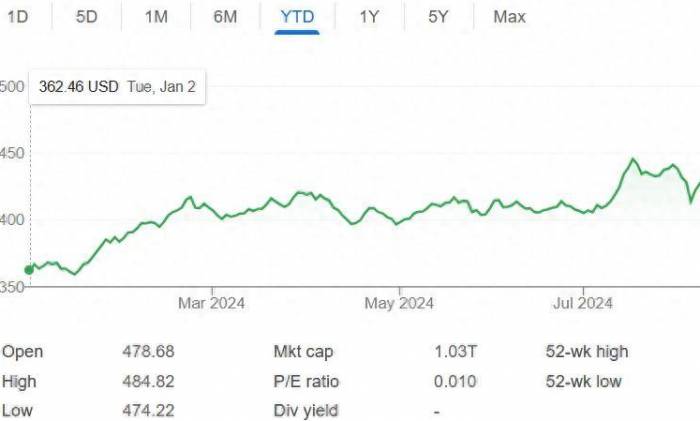

It is reported that OpenAI is developing new in-house AI chips, and xAI may have completed the construction of data centers. Reports on OpenAI chips could be positive for TSMC, but TSMC's U.S. stocks also fell sharply on Tuesday, dropping nearly 7% at one point.

As the industry enters a busy period for data, Broadcom will release its financial report on Thursday this week, Citi's TMT conference starts on Tuesday, Goldman Sachs' Communacopia & Technology conference will be held next week, and Nvidia CEO Jensen Huang will give a speech next Wednesday.Bartlett noted that although the start of September was poor, customer feedback did not indicate a high level of "pain," as their holding period for semiconductor stocks has significantly decreased, especially for most types of investors, including hedge funds. Goldman Sachs' top TMT expert, Peter Callahan, pointed out on Monday that the controversy surrounding the AI theme has noticeably increased compared to the previous two to three months.

Bartlett also noted that there has been a significant reversal in recent customer capital flows, with Goldman Sachs' trading department's capital flows showing that active customers are selling semiconductors and buying software: "Although the capital flows in our department were not very busy at first, we have seen a clear shift from semiconductors to software."

Additionally, UBS's trading department mentioned another blue-chip tech stock, Tesla, stating that on Tuesday, there were reports that Tesla plans to start producing the six-seat version of the Model Y in China by the end of next year, and it is said that Tesla has asked suppliers to prepare for a double-digit increase in Model Y production at its Shanghai factory. UBS pointed out that after Tesla released the Model Y in 2020, there was an internal project named Juniper to revamp the model, which was supposed to introduce a five-seat car, with its launch time postponed from the original plan this year to early next year.

UBS's institutional holdings data show that both hedge funds and long-only strategy investors have shorted/reduced their positions in Tesla. This is consistent with UBS analyst Joe Spak's previous downgrade of Tesla to underweight with a target price of $197. Spake's reason for the downgrade was that the market was too optimistic about Tesla's self-driving taxi project.

The financial blog Zero Hedge commented that Tuesday's sharp decline was an example showing that, because everyone was on the same side of the trade, the market could maximize the pain it could inflict on as many traders as possible.

Leave a Comment