01

After more than five years of the Sino-American trade war, it seems to be approaching a halftime break.

As everyone knows, the current global market is like a math teacher who has held over several classes in a row, leaving the students restless, all waiting for the Federal Reserve to cut interest rates, so that everyone can return to the joyful era of unrestrained monetary easing.

At present, it appears to be a high probability event that the Federal Reserve will cut interest rates in September. What people are more concerned about is whether the Federal Reserve will cut by 50 basis points or 25 basis points?

In the future, will the Federal Reserve start a continuous interest rate reduction mode?

Will the Chinese yuan appreciate significantly? Will the central bank once again initiate an economic model of massive monetary stimulus?

I don't know if anyone has noticed that recently, Biden's assistant Sullivan visited China for a short time but discussed a lot.

In addition to strategic communication on issues such as the Taiwan Strait, Ukraine, the Middle East, and the Korean Peninsula, the two sides of China and the United States also had an in-depth discussion on technology and trade issues.

According to the Ministry of Foreign Affairs, this communication was candid, substantive, and constructive.When translated, it means that both sides are not engaging in empty talk but are being straightforward and open about their concerns. Although there are significant differences, they can be addressed with a positive attitude through discussion.

What are the real issues of concern for the US and China?

Setting aside geopolitical competition.

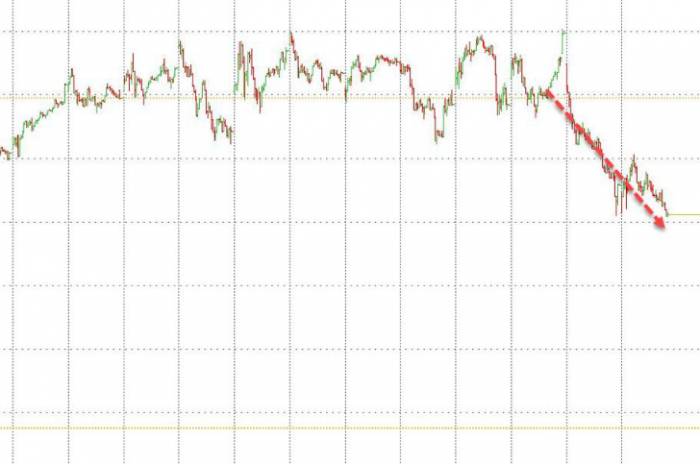

The US is most worried that once the Federal Reserve starts a continuous rate-cutting pattern, the US dollar's exchange rate will not hold up, domestic asset prices will plummet, followed by a collapse in the US stock market, and the inflation rate in society will rise again.

It's as if years of enduring a long contest of holding back urine have been in vain, with a rather grim outcome, which is obviously unacceptable to the US government.

On our side, we are concerned about technology sanctions and tariff barriers.

Everyone knows that the US has an entity list, and companies on the list cannot obtain US products, technology, and services. To avoid risk, international peers will also choose to stop or reduce cooperation with sanctioned companies.

Currently, there are about more than 600 Chinese companies and institutions on the US government's entity list, almost all of which are competitive internationally. Economic losses are one aspect, but more crucially, their products are also losing international competitiveness.

Let's take Huawei's mobile phones as an example. Before being on the list, Huawei's global market share for mobile phones once approached 20%, even surpassing Samsung to become the world's number one.

After being on the list, Huawei's global market share for smartphones fell below 5%, and its market position also declined from "slashing Apple" and "trampling Samsung" to that of an ordinary passerby.In terms of tariffs, prior to the trade war, the average tariff rate imposed by the United States on Chinese goods was approximately 3.1%. Following the trade war, the U.S. increased its tariffs on Chinese goods to around 19.3%.

This year, the Biden administration is considering further escalation, planning to raise tariffs on Chinese electric vehicles to 100% and to double the tariffs on semiconductors and solar panels to 50%.

This has dealt a significant blow to China's foreign trade exports. Data indicates that in 2023, the trade volume between China and the United States decreased by $102.1 billion compared to 2018, representing a year-on-year decline of 13.9%.

02

Thus, a logical point emerges.

After several years of extreme tension between China and the U.S., they still cannot escape the path dependency of exchanging dollars for goods. The U.S. needs Chinese goods to combat inflation, while China needs U.S. dollars to stimulate the market.

It's important to note that over the years, Americans have successively introduced concepts such as the metaverse, superconductivity, nuclear fusion, artificial intelligence, etc., pushing the U.S. stock market to one climax after another. Now, aside from extraterrestrial civilizations, almost all conceivable concepts have been speculated on.

The bubble in the U.S. stock market has reached a historical peak, and even the legendary Warren Buffett is leading the exodus. If the Federal Reserve does not pump more money into the system, the U.S. stock market may well repeat the massive collapse of the internet bubble at the beginning of this century.

However, the issue is that printing more dollars requires someone to take on the burden.

If the newly printed greenbacks cannot be exported overseas, the dollar will significantly devalue and trigger domestic inflation. Currently, the renminbi, yen, and euro are recovering, while the dollar is barely holding on at the 100-point threshold.The Democratic solution is to return to the old path, with the United States responsible for printing money and China responsible for production, using China's cheap industrial products to offset social inflation while stabilizing the US dollar exchange rate.

What is the situation on the Chinese side?

In recent years, as we no longer need so many US dollars, the three driving forces of the economy have clearly become somewhat weak.

Americans often talk about "overcapacity," which is not that we really have overcapacity, but rather that exports are limited.

The manufacturing industry faces the global market, which certainly has insufficient capacity, but if it only meets domestic demand, it is indeed a bit too extravagant.

Let's take domestic new energy vehicles as an example. In the first half of this year, the total production of new energy vehicles in China was about 4 million, and the overseas market has obviously improved, but only 800,000 vehicles were sold, which means that 80% of the capacity has to be absorbed domestically. Car companies have no choice but to compete internally to survive.

Foreign trade is not strong, and this is also reflected in the domestic consumer market.

Because factories have no orders, workers' income and employment will decrease, everyone's wallets are cleaner than their faces, and they are even more reluctant to consume in advance or take over the real estate market.

Seventy percent of the wealth of the Chinese people is locked in real estate. If housing prices continue to rise, there will definitely be problems, but the consequences of not rising and no one taking over are that all basic consumption related to people's livelihoods will face a comprehensive surge.

So, the US dollar is a poison, but for now, we still have to continue to accept it.The United States wants to stimulate the economy without causing high inflation, which necessitates lifting the high tariffs on Chinese goods and some technology sanctions. Meanwhile, as China unleashes its production capacity and the central bank follows with interest rate cuts, domestic debt issues can be resolved, and Chinese enterprises can regain their overseas market share.

The current negotiations between China and the U.S. are about how much to concede and how much to accept, as both sides have needs that the other can fulfill. Despite any rhetoric, business must continue.

The first round of intense tug-of-war between China and the U.S. is likely to end in this manner, and what follows will probably see not only both countries but also the world's major economies turning on the monetary taps.

The rationale is straightforward: the dominant play in modern economies is debt-driven, which means using borrowing to fuel economic growth and consumption. For instance, when a central bank issues $100, it can be multiplied to $1,000 by commercial banks, with debt growing exponentially.

Currently, the United States' debt has surpassed $35 trillion, accounting for about 125% of its GDP; China's debt, excluding local government hidden liabilities, is around $13 trillion, roughly 80% of its GDP; Japan may claim that domestic debt is not a burden, but its debt has reached 1100 trillion yen, approximately 260% of its GDP; Germany's debt level is relatively low among the main economies of the EU, but it still exceeds 2.7 trillion euros, representing 65% of its GDP.In the past few years, everyone has been holding back from lowering interest rates, mainly out of concern that the exchange rate might not be stable. Once the Federal Reserve cuts interest rates, central banks from various countries would inevitably follow suit and ease monetary policy.

03

So here comes the question again, our data has been poor over the years, but why does the central bank insist on not easing monetary policy? So why do we also follow suit when the Federal Reserve lowers interest rates?

How to put it?

In fact, from 2020 to 2023, the central bank has been easing monetary policy, but the funds have not flowed into the real economy.

Due to the unfavorable overall environment, foreign trade companies are at risk of bankruptcy at any time, banks are hesitant to lend to them, and yet they must fulfill their lending tasks, so they offer ultra-low-interest loans to large state-owned enterprises.

But the problem is, after these enterprises receive low-interest loans, they do not expand production. Instead, they turn around and buy large amounts of fixed deposits and principal-protected financial products, effectively earning interest without doing anything, and some daring and meticulous state-owned assets supervision and administration commissions even go to the United States to buy ETFs, and surprisingly, they have nearly doubled their profits in three years.

This is the fundamental reason why funds are circulating in the system without flowing into the real economy.

Therefore, only when the Federal Reserve lowers interest rates, and Chinese goods are sold, can enterprises obtain financing to expand reproduction. When everyone has money in their pockets and are willing to consume in advance, the central bank's easing policy can truly take effect.

The United States usually stimulates the economy by "helicopter money," which means directly giving money to the public, thereby driving consumption.What we are engaged in is a top-down approach, where the central bank's excessive money issuance needs to first satisfy state-owned enterprises, state-owned corporations, and the government, and then it is circulated to the hands of ordinary people through the division of labor in the industrial chain.

Regardless of how the forms on both sides change, the purpose of easing monetary policy will always remain the same.

In recent years, people have been hesitant to consume, mainly due to the uncertainty about the future.

But now the situation is gradually becoming clear. The United States has reached a point where it has to ease monetary policy because if it doesn't, its own Ponzi scheme will collapse.

Our manufacturing and real estate industries will also catch a breath due to the interest rate cuts in the US dollar, which will win valuable time for China's industrial transformation.

However, it should be noted that Sullivan represents the Democratic Party.

If Harris can win the US election, then the system of exchanging dollars for goods can continue, and the cost of China's industrial expansion can also be controlled at a relatively low level.

But if President Trump takes office again, it would be another version of the Sino-American game.

Leave a Comment