The AI boom has led to a significant surge in related stocks, but it is clear that not all companies can withstand the test of fire. Only when the tide recedes do we find out who is swimming naked.

Media reports indicate that investment institutions have begun to short some AI concept stocks that have risen with the trend, including Super Micro Computer Inc. and Lumen Technologies Inc., whose share prices have increased by more than 250% this year.

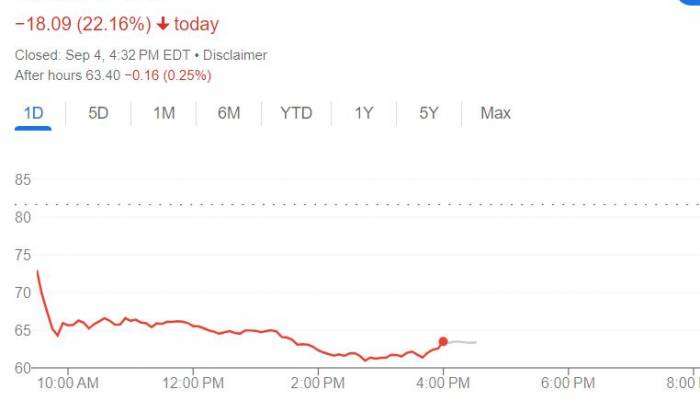

By the end of last month, companies like Super Micro, Lumen, and Symbotic Inc. faced short-selling, with institutions questioning their valuations, leading to a significant drop in stock prices. Super Micro's market value was around $36 billion at the beginning of last week, but it fell to approximately $26 billion by the weekend. This was due to a report released by the well-known short-selling institution Hindenburg Research on Tuesday, which pointed out "obvious accounting issues" and other problems, triggering a corporate governance crisis.

"We are distinguishing the winners from the losers," said Ken Mahoney, CEO of Mahoney Asset Management.

Analysts believe that the reaction to NVIDIA's financial report last week shows how unstable the situation can become. Although the chip manufacturing giant exceeded analysts' expectations, its stock price fell by 6.4%. The reason, according to some analyses, is that since the beginning of 2023, NVIDIA's stock price has risen by over 700%, and investors have become accustomed to NVIDIA not just meeting expectations but completely smashing them. With its stock "perfectly priced," Mahoney stated that the company, valued at $3 trillion, is ready to face a sell-off of up to $200 billion.

However, Mahoney pointed out that NVIDIA and other large AI companies among the U.S. "Seven Sisters" have consistently performed well in terms of performance and growth. This is why they differ from companies like Super Micro, whose performance has been "unstable," he said.

Unstable performance attracts short-sellers

Analysts believe that this instability, coupled with rapid stock price increases, makes such stocks particularly vulnerable to the impact of short-seller allegations. About 24 hours after the release of Hindenburg's report, Super Micro Computer responded that it needed more time to assess the internal controls of its financial reporting.

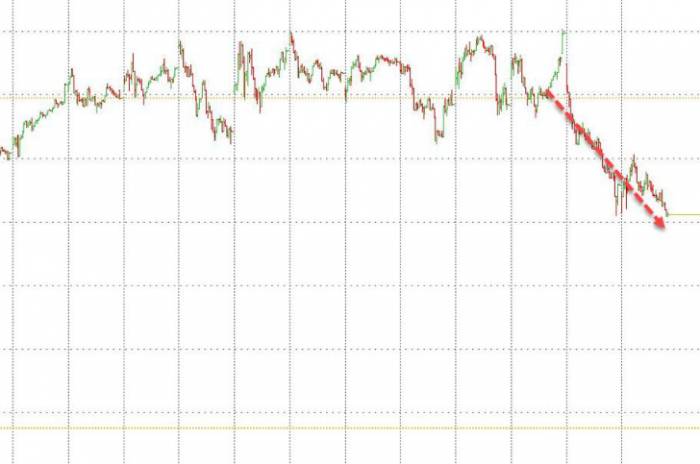

Tuesday was also a tough day for Lumen Technologies, as Kerrisdale Capital announced on social media platform X that it was shorting the stock due to "deteriorating sales and profit margin trends, as well as a huge debt burden." The stock of this fiber optic network company rose rapidly in July, from about $1 to over $6.50, but plummeted after the news broke, currently trading at around $5.

Meanwhile, SoftBank-backed Symbotic saw its market value shrink by 23% in less than two weeks, as a short-selling report claimed that drone footage showed no business activity at some of the company's locations. The warehouse robot company positioned itself as a beneficiary of AI and reached a joint venture investment agreement with SoftBank last July to purchase its AI-driven systems, with its stock price more than double the Friday closing price at that time.Hindenburg's gaze is not solely fixed on ultra-microcomputers; the institution has once again taken aim, releasing a report last week that accuses iLearningEngines Holdings Inc., a company that claims to be an "AI platform for learning and work automation," of fabricating its financial data. The stock price plummeted by 53%, while the company stated in a declaration that it believes the report contains misleading statements.

A digestion period is currently underway.

However, historically, such drastic fluctuations occur when the market becomes infatuated with new technologies, as seen with the invention of radio and the development of the internet. At present, the benefits of artificial intelligence are still being explored. Valuations of AI startups have skyrocketed, and this phenomenon has spread to the stock market, creating a surge in AI concept stocks.

John Belton, a portfolio manager at Gabelli Funds, previously stated, "The stock market always goes too far, too fast, and then experiences a digestion period. For many companies, we are going through a healthy digestion period."

This is not the first time investors have taken a bearish stance on companies whose stock prices have soared due to AI expectations. In March, Hindenburg shorted data center owner Equinix Inc., and in July, Culper Research questioned the AI vision of Bitcoin miner Iris Energy.

Analysts believe that, from this perspective, the pullback of some AI concept stocks and the questioning of valuations for companies related to this technology indicate that investors are beginning to ponder the ultimate value of it all and which companies will have long-term growth.

"We don't know how big this is going to be; this market context could lead to some small-scale excesses," Belton said. "We are still in a phase of the generative AI investment cycle, in which it is difficult to know the shape of the long-term cycle."

Leave a Comment