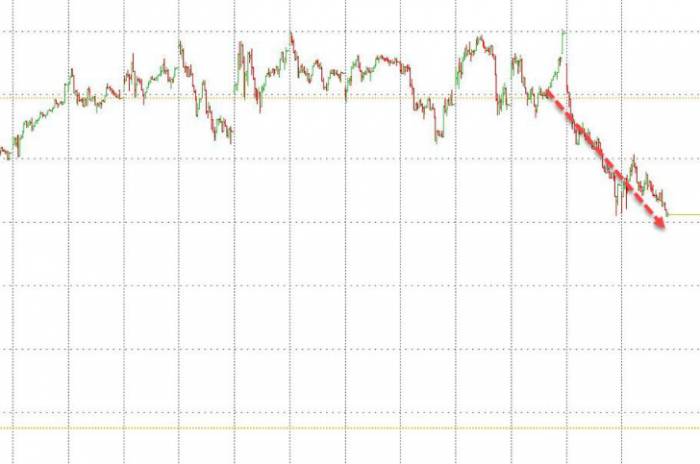

On Tuesday, international oil prices plummeted significantly, with Brent crude erasing all gains made so far this year. WTI crude oil saw an intraday drop of 4.5%, settling at $70.24 per barrel. Brent crude suffered a 5% decline, trading at $73.65 per barrel. In terms of news, the Central Bank of Libya, an OPEC member country, indicated that factions were close to reaching an agreement, which could facilitate the resumption of oil production.

As of the close of trading that day, the October WTI crude oil futures fell by $3.21, a 4.36% decrease, to $70.34 per barrel, approaching the closing price of $69.99 on January 8th.

On August 26th, the eastern government of Libya declared "force majeure" on all oil fields, terminals, and petroleum facilities, halting all oil production and exports, stating that this move was in response to the Tripoli government's attempt to take over the Central Bank of Libya. The western government of Libya attempted to dismiss the Central Bank Governor Sadiq Al-Kabir, leading to the eastern government reducing oil output.

Al-Kabir stated on Tuesday that there were strong indications that factions were nearing an agreement to break the current deadlock. Despite fleeing Libya after threats from armed groups, he expressed in an interview in Istanbul, Turkey, that he believes he will be part of the solution and is prepared to return to his country.

Last week, the cessation of Libyan oil production posed a risk of a supply reduction of over 500,000 barrels per day. The recent easing of relations between the rival Libyan governments could pave the way for the return of over 500,000 barrels of oil production to the global market per day. The market is closely monitoring developments in Libya.

On the same Tuesday, the latest survey results from Bloomberg showed that OPEC produced 27.06 million barrels of oil per day in August, a month-on-month decrease of approximately 70,000 barrels per day. The impact of Libya's decision to restrict production and exports at the end of August on the overall situation was negligible, as the event occurred only at the end of the month. The supply disruption in Libya was offset by a slight increase in production from other member countries.

Looking at specific member countries:

- Saudi Arabia, Algeria, and others are complying with their quotas.

- Libya's daily production decreased by 150,000 barrels per day in August. In the last week of August, Libyan production fell by over 500,000 barrels per day, a drop of about 50%.

- Nigeria and Kuwait saw a slight increase in their production.Iraq has not yet fully reduced its production, despite repeated promises to do so and even to compensate for the excess crude oil it produced earlier. Iraq's daily production in August was 4.32 million barrels, 320,000 barrels above the agreed quota.

The aforementioned survey data from Bloomberg is based on ship tracking data, information provided by officials, and estimates from consulting firms including FGE, Kpler, and Rapidan Energy Group.

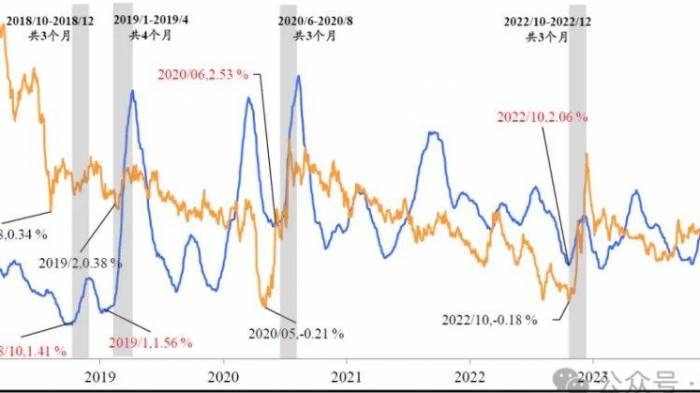

The market is focusing on OPEC+'s oil production plans. Reuters reported last Friday that OPEC+ plans to continue the previously proposed production increase plan in the fourth quarter. Affected by this news, oil prices fell sharply during the trading session. OPEC+ has repeatedly emphasized that it can suspend the production increase plan if necessary, or reverse the action and continue to reduce production. With Brent oil erasing its gains for the year, current oil prices are too low for many OPEC member countries to cover government expenditures.

It should also be noted that U.S. oil companies are now producing more oil with less capital investment. Although the growth of U.S. oil production will slow down in the future, U.S. oil production is expected to continue to set records in 2024 and beyond.

In 2019, the total capital expenditure of 10 U.S. oil companies was $20 billion, with a total production of 2.8 million barrels of oil equivalent per day. By 2024, these companies have increased their production by 36% with only an 8% increase in capital expenditure.

As the resilience of the U.S. oil industry increases, this may have a significant impact on OPEC+'s production decisions, limiting the space for OPEC+ to increase production later this year.

Leave a Comment