The PCE report indicates that inflation continues to rise moderately, while household spending remains stable, reinforcing the prospect of a soft landing. Analysts expect that the data will not affect the Fed's anticipated interest rate cut trajectory.

Friday's data showed that the Federal Reserve's preferred inflation gauge rose at a moderate pace in July, with household spending remaining stable. This suggests that policymakers have so far been able to curb price pressures without inflicting too much pain on consumers, achieving a soft landing, and thus diminishing the necessity for a 50 basis point rate cut by the Fed in September.

The U.S. core PCE price index annual rate recorded 2.6% in July, consistent with the previous month and slightly below the market expectation of 2.7%; the monthly rate remained at 0.2%, in line with expectations. The U.S. PCE price index annual rate recorded 2.5%, lower than the expected 2.6%, and unchanged from the previous reading of 2.5%; the monthly rate increased from 0.1% in the previous month to 0.2%, as expected. The U.S. personal spending monthly rate rose to 0.5% as expected from 0.3% in the previous month.

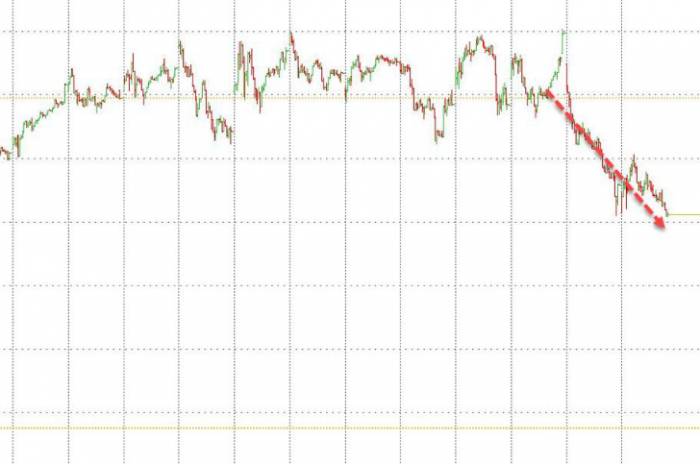

Following the release of the PCE data, spot gold fell by $6 in the short term, and the U.S. dollar index rose by 16 points in the short term. U.S. short-term interest rate futures fell slightly. U.S. stock index futures edged up.

Analysts stated that the overall U.S. personal income and spending data were positive, with income and real spending slightly better than expected. The overall price index was in line with expectations, while the year-over-year change in core prices was slightly below economists' forecasts. The super core service sector inflation rate for the month was 0.21%, comparable to May and June.

The analyst believes that, overall, there is nothing to prevent the Fed from cutting rates next month... but for the same reasons, there is also no evidence to suggest a 50 basis point rate cut. Therefore, these data may not cause significant fluctuations as the end of the month approaches (and a week after the release of employment data).

U.S. consumer spending grew solidly in July, indicating that the economy remains on a relatively solid foundation at the beginning of the third quarter, which is not conducive to providing arguments for some who believe the Fed needs to make a significant rate cut next month.

After the unemployment rate jumped to 4.3% in July, a nearly three-year high, concerns about the health of the U.S. economy have arisen, prompting some calls for a 50 basis point rate cut by the Fed in September. However, policymakers have also noted that the slowdown in the labor market is mainly due to fewer hires rather than layoffs.

Most economists still believe that the Fed will reject a 50 basis point rate cut, as the economy continues to grow robustly, and although inflation has slowed significantly, it remains above the 2% target.

Vanguard's Chief Economist Joe Davis expects the July PCE data not to affect the Fed's anticipated rate cut trajectory. He believes that the Fed will cut rates by 25 basis points at its meetings in September and December of this year.Federal Reserve Chairman Jerome Powell indicated last week that the time has come for the Fed to cut key policy interest rates. He affirmed the expectation that Fed officials will start reducing borrowing costs next month and made it clear that he intends to prevent further cooling of the labor market.

ING Bank analyst Francesco Pesole pointed out that, due to the market's conviction in the Fed's easing policies, the bulk of the dollar's decline may have already occurred. Furthermore, the proximity of the U.S. Labor Day holiday next Monday may also favor range trading on Friday.

Leave a Comment