Libya's political crisis has once again plunged its oil production into chaos. However, for OPEC+, which is trying to increase production, the chaotic situation could not have come at a better time.

After the Libyan Government of National Unity, led by Prime Minister Abdul Hamid Dbeibah and recognized by the United Nations, replaced the Central Bank Governor Sadiq Al-Kabir, the eastern authorities in Libya shut down more than 500,000 barrels per day of oil production, equivalent to half of the North African country's crude oil daily capacity. According to data from the National Oil Corporation of Libya, as of August 1, the country's daily oil production was 1.27 million barrels. The country's central bank manages billions of dollars in oil revenue for two opposing governments.

All export terminals in the east of the country were closed on Thursday. Rapidan Energy Group, an energy consulting firm, believes that the production disruption could increase to 1 million barrels per day, which is about 1% of the global supply. Fernando Ferreira, Director of Geopolitical Risk Services at Rapidan, based in Washington, also stated: "Overall, we expect daily production outages to reach between 900,000 and 1 million barrels and last for several weeks."

The crisis this week follows the shutdown of Libya's largest oil field, Sharara, earlier this month, which has already led to a daily reduction of 300,000 barrels in market supply. Global oil prices have fluctuated, with Brent crude futures prices climbing above $80 a barrel on Thursday. Due to traders' perceptions of slow demand growth and ample supply across the Americas, the oil price benchmark is still down 2.5% from early July. However, if the shutdown in Libya continues, the oil price reaction could intensify.

Historical context of the struggle for control of the central bank

During Gaddafi's 42-year rule, the country's state institutions collapsed, and his fall left a vacuum filled by countless militia groups, many of which were based on tribal backgrounds. Since his ousting in 2011, the country has been plagued by unrest, and its energy resources have been a key battleground for factions vying for political advantage and access to petrodollars, leading to frequent production stoppages.

In 2014, the country was essentially divided in two, with the wealthier western region in dispute with the eastern region, which holds most of the oil production and export terminals. Despite the ceasefire agreement brokered by the United Nations in 2020, which promised new elections, none have been held to date, leading to further division in the country.

In 2020, the leader of the eastern-based Libyan National Army, Khalifa Haftar, orchestrated an eight-month production shutdown. This is the most severe shutdown since then. Haftar, who had been opposed to Kabir during his 13-year tenure as central bank governor, has now turned to support him.

The latest situation in the country also symbolizes the end of the arrangements brokered by the United Nations in 2021 to reconcile the two opposing factions. Richard Bronze, Geopolitical Principal at consulting firm Energy Aspects, stated: "Even with a compromise on controlling the central bank, the fragile agreements that have provided relative stability for Libya's oil industry over the past few years seem to be breaking down."

"By 2025, production could become more volatile and prone to shutdowns."For OPEC+, the timing couldn't be better

Jalel Harchaoui, a research fellow at the Royal United Services Institute in London, stated that the latest dispute might be eased if governments signal that the new central bank will be prohibited from transferring US dollars. However, he warned that "there is currently no clarity to this extent." Harchaoui added:

"If the United States does not take firm, consistent, and swift action, and without significant help from other influential countries such as Turkey, the crisis could become more severe... At this moment, there is no room for complacency or optimism."

Nevertheless, for other oil-producing countries in OPEC+, the Libyan crisis comes at an opportune time, as they are hesitating over plans to start restoring production.

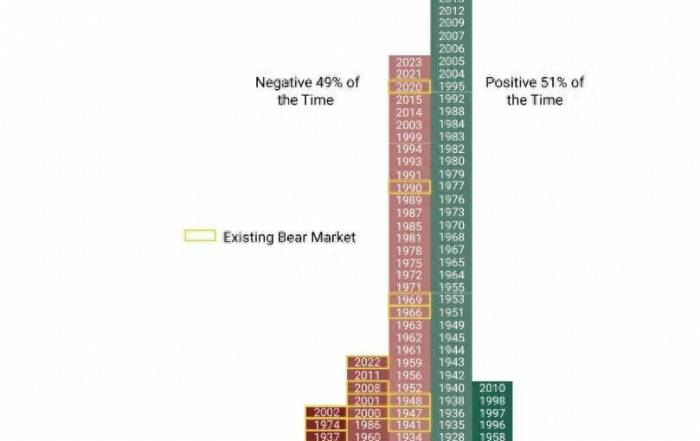

Led by Saudi Arabia and Russia, OPEC+ has been cutting production by several million barrels per day since 2022 to support oil prices. The organization tentatively plans to restore production of 543,000 barrels per day in the fourth quarter and will make a decision on this approach in the coming days.

Analysts warn that increasing supply could lead to a global market glut, but Libya's prolonged production halt may change the situation. Tamas Varga, an analyst at broker PVM Oil Associates Ltd, said:

"This could be the perfect excuse for the oil-producing alliance to decide to increase production."

Leave a Comment