Real estate price caps have once led to a series of disorders. Now that many local governments have lifted these caps, what impacts will follow?

Price caps, by limiting both increases and decreases, did not respect market laws, thus leading to many irregularities at one point.

When the real estate market was still on the rise, price caps caused a reversal in the pricing of new and second-hand homes, with new homes being significantly cheaper than second-hand ones. In cities like Hangzhou, this led to a situation where second-hand homes were left unsold while new homes required a queue and lottery system to obtain qualification.

Now, as the real estate market enters a downturn, price caps have also led to subtle changes in the attractiveness of new and second-hand homes. New homes, due to their initial pricing range, are noticeably more expensive than second-hand homes in some areas. As a result, in 2023, the transaction volume of second-hand homes in China surpassed that of new homes for the first time, with the new home market becoming increasingly quiet.

A couple of years ago, news would frequently report that certain developers had their qualifications revoked for selling at reduced prices or through disguised price reductions. At that time, no one expected the downturn in real estate to last this long, including the government, which did not anticipate it. Even after a series of policy relaxations, the real estate market still showed no signs of recovery.

Therefore, recently, some local governments have proactively lifted price caps...

According to statistics from the China Index Academy, this year, cities such as Shenyang, Lanzhou, Zhengzhou, and Ningde have explicitly stopped implementing price guidance for the sale of new commercial housing.

Why lift the price caps?

It is to increase volume! The expansion of transaction volume is crucial for real estate companies and local governments at this stage.For the Chinese economy to recover at present, there are only three possibilities: the recovery of consumption, the recovery of technology and foreign trade, or the recovery of real estate transactions.

Currently, consumption and foreign trade are more difficult to regulate, and in contrast, real estate still has some potential. In China, real estate investment can account for 20% of the overall economy, and every 5% change in real estate investment can cause a fluctuation of 0.6%-0.7% in GDP.

Therefore, stimulating the transaction volume of real estate at present is very important for the economy. Price limits are one of the obstacles currently preventing an increase in transaction volume.

I. The impact of lifting price limits

Price limits go against the laws of the market economy, increasing the communication costs for both buyers and sellers.

In a high-tier city, a property valued at 3 million yuan may have a maximum sales price set at 2.5 million yuan, in which case the seller would not sell. In a low-tier city, a property valued at 1 million yuan may have a minimum sales price set at 1.5 million yuan, in which case the buyer would not buy. Thus, regardless of the type of price limit, the result is a reduction in buying and selling, leading to a decline in transaction volume. Without sufficient funds for real estate companies to recycle, how can they maintain cash flow and repay bank debts?

Therefore, lifting price limits is an inevitable attempt at present.

The real estate industry as a whole is currently in a downturn. Due to market pessimism, there are far more people selling than buying. Thus, a property that was originally valued at 3 million yuan may have to be reduced to 2.5 million yuan to potentially be sold.

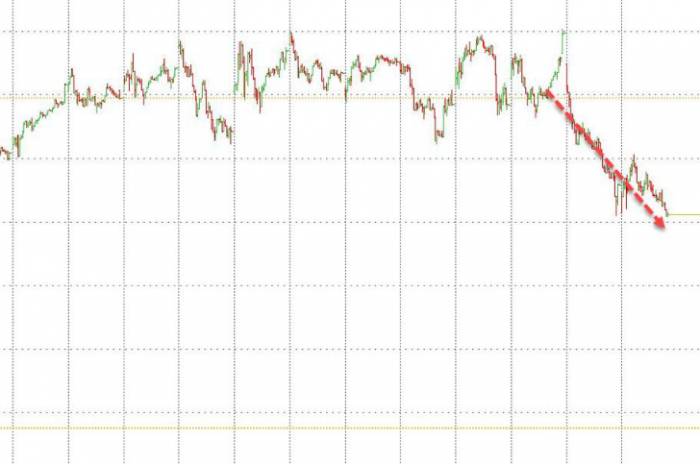

In a normal, stable market without fluctuations and price limits, the graph of buy orders and sell orders would look like this (as shown in the figure). When buy orders and sell orders touch, a transaction occurs, with most transactions taking place near 3 million yuan. In a declining market, the lower the price, the more buyers there are. Once sell orders lower the price sufficiently, they will touch more buy orders, and thus the transaction volume will also increase.However, in a bearish market with price ceilings, the chart of buy and sell orders might look like this. Since it is already a bearish period, the willingness to buy is not strong enough. For a house worth 3 million, people are only willing to offer up to 2.5 million. Yet, the policy has capped the price, requiring that properties cannot be sold for less than 3 million. Thus, a gap appears between the buy and sell orders (as shown in the figure). Buyers and sellers can never agree on the price; buyers find it too high and simply stop purchasing. Consequently, the transaction volume of real estate in the market significantly decreases.

In a bearish period, after lifting the price ceiling, because everyone's expectations are not favorable, many people want to quickly sell their properties at a low price for cash. Therefore, the future real estate market might look like this: the red section shifts downward as a whole until it touches enough green buy orders to stabilize at a new price level (as shown in the figure). Those who want to sell their properties lower the price to a certain extent and finally reach the psychological price of some potential buyers. As a result, the market will start to see more transactions compared to before. As the transaction volume increases, the price gradually falls, which is known as "volume increase with falling prices." However, once there is transaction volume, real estate companies have funds to recycle, and many hidden debt issues in various links can be more easily resolved.

The increase in volume is a good thing, but if the price falls beyond a reasonable range, it is not good for the government and banks. Therefore, the government prefers the market to have a stable volume with a slight decline, even if it is worse. Since it is unknown how many buy orders are below, the lifting of price ceilings is only being piloted in some cities. Thus, the next six months to a year will be the most critical period for real estate data.

II. How will the real estate market trend in the next two to three years?

For the market to reverse, it must go through a round of increased volume, whether it is a volume increase with falling prices or rising prices. If, like before, due to policy and other reasons, people's confidence turns around and their expectations for the future become very strong, the market, like in 2016, will complete the turnover through an increase in volume, leading to a market inflection point. If people are very pessimistic about the future market, then the market will be driven by sell orders, leading to a round of increased volume with falling prices, thus entering a stage where prices stabilize.

The increase in transaction volume represents that the market has completed a full turnover. Those who want to buy have taken over the vast majority of the properties from those who want to sell, and there is not much selling pressure above. Prices will begin to stabilize, and the market will enter a period of phased stability.

Why is it called phased stability? Because long-term trends are hard to change. High-quality properties that will increase in value will still rise, and marginal properties that will fall in price will still decrease. Phased stability is just a description of the overall real estate market.

Japan's real estate market collapsed in 1990 and continued to fall for nearly four years. At that time, Japan experienced a collapse-style decline, so the drop in property prices was greater. In just 1992, there was a year-on-year decline of 12%. However, after four years, the Japanese real estate market miraculously stabilized.

At that time, to save the market, Japan also introduced a series of loose policies. From August 1990 to September 1993, the official discount rate was lowered six times, from 6% to 1.75%, and emergency measures with a project scale of more than 10 trillion yen, centered on public projects, were successively introduced. In 1995, Japan began to stabilize and recover, and housing prices began to slowly recover. From 1995 to 1997, the average price of newly built apartments in Japan increased by about 5.92%. However, after that, Japanese housing prices continued to fall, and the economy also fell into a slump... So what was later said was not that the Japanese economy lost four years, but twenty years.

Even if the real estate enters a downward trend, phased stability and recovery will also occur. If we simply follow the pattern of Japan's several real estate fluctuations, pessimistic sentiment is basically released once every four to five years. Then, considering China's real estate from mid-2021 to now, three years have already passed. Perhaps after some more digestion of the market's pessimistic sentiment, in the next one or two years, the market may experience phased stability, which is also possible.The trajectory of asset prices unfolds in accordance with overarching trends. Therefore, after a surge in real estate transactions, the market may experience a temporary stabilization, but it cannot alter the long-term trend. Core, high-quality properties, akin to those in Kyoto's circle in Japan, will see a significantly smaller decline compared to peripheral properties during the market's downturn. Subsequently, when the market recovers, their prices will also rise more significantly.

In conclusion, the most challenging aspect to predict today is the long-term economic situation of China in the future. After Japan's collapse, it faced the Asian financial crisis, the global internet bubble burst, and the subprime crisis within a few years. With internal issues compounded by unfavorable external circumstances, Japan entered a new cycle of decline after a temporary rebound in housing prices in 1996.

Thus, the information above can be summarized into two main conclusions:

1. After the relaxation of price controls, it is quite likely that the real estate market will experience a temporary surge and stabilization. However, this temporary stabilization will not change the overall trend.

2. There are two main trends in the overall real estate market. For the market as a whole, if China's economy shows a significant recovery and debt leverage is adequately cleared, the real estate market will start to rise again. For individual properties, differentiation is one of the major trends. Leading real estate hubs like Shenzhen, along with many high-quality properties, will consolidate during the downturn and continue to rise during the upturn, similar to the property trend in Kyoto's circle in Japan. This is because, compared to demand, supply has been chronically scarce, and in the long run, the value will only increase. On the contrary, properties in smaller cities, especially peripheral ones, will experience a greater decline during market downturns (of course, this is predicated on the assumption that price controls are lifted in smaller cities; if price controls are not lifted, these peripheral properties will have their prices artificially stabilized, but with severely reduced transaction volumes).

Lifting price controls is a bold policy experiment and a necessary attempt at the current juncture. We anticipate that it will play a role in future markets, bringing a sufficient volume of transactions. If everything unfolds as expected... a temporary economic recovery is also something to look forward to!

Leave a Comment