China has stepped out of a situation that is contrary to the global economic trend!

I. Current Global Economic Situation

If we only look at GDP, China's GDP figures have not changed significantly and are still growing at a high speed of around 5.3%. However, such economic data is difficult for the public to feel. This is because the growth rate of the total retail sales of consumer goods has been 3.7% and 2.3% in the recent two to three months, whereas when the GDP growth rate was at 6%, the consumption growth rate was above 8%.

Looking at the data published by the National Bureau of Statistics, the current economic growth of China is largely completed by the government's investment in infrastructure construction. Moreover, it is accomplished by a few economically developed regions. The vast majority of local governments across the country do not have the fiscal strength to engage in infrastructure investment.

Overall, the GDP data is now secondary; the underlying consumption momentum is more important. For the government, if consumption does not increase, the economic circulation is not smooth, and tax revenue becomes a problem. If large consumer goods such as cars and houses do not increase, the government's debt and corporate debt remain difficult to resolve.

A lack of funds is a problem that every entity in China is currently facing!

We have discussed government debt many times. This year, the main task for many local governments is to reduce debt, not to develop. For businesses, especially real estate companies, there is still too much debt, and they are all borrowing new money to repay old debts, delaying time and gradually reducing it. In June of this year, the M2 growth rate hit a new low, at only 6.2%. Many people still wonder how can everyone be short of money when China has printed so much money? In fact, the situation is not at all like this. Since 2015, China's benchmark interest rate has not changed. What has been moving in recent years is the Loan Prime Rate (LPR), which has indeed been decreasing. The LPR has been lowered again and again, and the loan interest rates of many banks are also very low. However, this does not prevent everyone from being short of money.

Local government debt is high and cannot issue bonds and borrow money indiscriminately. In terms of finance, there is not much money available. With weak consumption and poor business performance, businesses do not need to add too much leverage. Nowadays, individuals are also cutting back on spending. How many people dare to take loans to buy houses, cars, and consume? In the past, people in China often suffered from inflation, with frequent price increases causing distress. However, when entering a deflationary period, we suddenly find that although the money in hand has become more valuable, the difficulty of making money has also increased.

In June, China's CPI data was 0.2%. This is a data point that is neither here nor there; you can say it's deflationary, but it's not negative. You can say it's healthy, but it's still quite far from it. Many macroeconomic data points are like this now. This feeling is like getting a score of 59 in an exam...China's economy, it's like scoring 59 points! It's short of money, but it's just short of one dollar. However, that one dollar is unattainable because it has done everything possible to make the score up to 59.

Looking at the United States. The U.S. economic growth rate in the first quarter was actually only 1.6%, far below the expected 2.5% at the time. But the majority of the U.S. economy is supported by consumption. Employment data and price indexes are crucial. The U.S. economy, employment data, and capital market trends are highly correlated with monetary policy. Once there is a change in monetary policy expectations, these figures will show significant fluctuations.

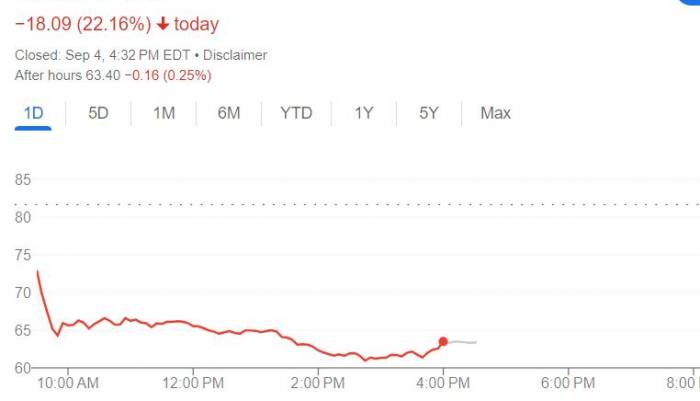

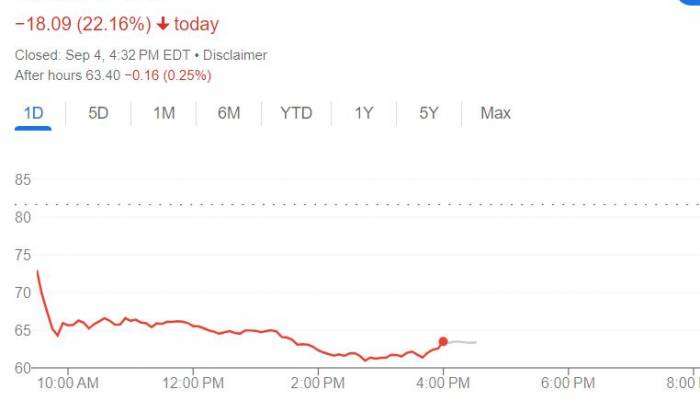

In June of this year, the U.S. non-farm employment positions increased by 206,000, and the unemployment rate rose from 4% to 4.1%, reaching a new high in two and a half years. At the same time, the U.S. CPI data in June rose by 3% year-on-year, falling by 0.3 percentage points compared to the previous month. Currently, the most significant factor affecting the U.S. economy and capital markets is the timing and pace of interest rate cuts.

With inflation continuing to fall and employment data rising, it means that the probability of the U.S. cutting interest rates in September has greatly increased.

Although the U.S. economy is not doing well today, its problem is inflation. Suppressing hyperinflation is something the U.S. has been doing for the past two years.

Originally, as the U.S. was about to enter the interest rate cut cycle, the U.S. dollar should have entered a depreciation channel. However, so far this year, the U.S. dollar index has not decreased but increased (as shown in the figure), and funds continue to flow back to the U.S. The global capital inflow has also injected momentum into the U.S. capital market, and the rise in the U.S. capital market has also brought considerable wealth growth to the American people. The good or bad of the economy is always relative. The poor performance of the eurozone and other regions has highlighted the relatively stronger resilience of the U.S.

In the latest data released, the eurozone's composite PMI data fell from 52.2 in May to 50.9 in June. Although the service industry is a bit better, the manufacturing PMI is still below the boom-or-bust line. In the latest GDP data, the growth rate of the eurozone is only 0.1%. Currently, internationally, the monetary policies of most countries and regions are changing in line with U.S. monetary policy. Looking at the price data in May, the eurozone inflation rate has fallen to 2.6%, so the eurozone will also start to enter the interest rate cut cycle in the second half of this year.

Here, we see the current international economic situation. The U.S., Europe, and China, these three major regions, are generally not doing well, but the strengths and weaknesses are different. Relatively speaking, the U.S. economy is still the stronger side. In fact, if we are willing to look more closely, countries like India, as well as Vietnam, Indonesia, and other Southeast Asian regions, have relatively better economic growth rates, but their scale is somewhat smaller compared to these three major regions.

The economic problem currently faced by Western countries is inflation, while the problem faced by China is deflation. The West is gradually moving from the peak of monetary tightening to monetary easing. On the surface, China's monetary policy is already sufficiently loose, but in reality, it is becoming increasingly short of money.

II. Impact on China?The existing shortage of funds in China is influenced by both internal and external factors. Internally, the issue stems from insufficient liquidity of capital, lack of confidence in consumption and investment. Even with low interest rates, funds are stagnant within financial institutions or circulating idly within a few institutions, yielding minimal gains.

Externally, the divergence in monetary policies between China and the United States plays a role. Overseas, the current phase is nearing the end of an interest rate hike cycle, with medium and short-term government bond rates and many money market fund rates around 5%. In contrast, the lower loan and deposit rates in China have led to a continuous outflow of capital.

The Chinese yuan's exchange rate against the US dollar began to depreciate rapidly from the beginning of 2023, and this year, it has been fluctuating around 1:7.2. The pressure to depreciate remains significant. Although it may be difficult to break through the important psychological threshold of 7.4 this year, the situation for next year is uncertain. With such a high interest rate differential between overseas and domestic markets over the long term, it is challenging for the exchange rate to appreciate for an extended period.

For the domestic economy, which is already short of funds, if it were not for the current effective policy controls, the emergence of a long-term expectation of capital outflow would deal a devastating blow to the domestic stock market and real estate. Therefore, at this stage, maintaining the expectation of the exchange rate at 7.4 is also a crucial part of the strategy.

Looking back, the economy is contracting in the East and inflating in the West. The most realistic way to break through the current economic environment is for other regions around the world to gradually improve, so that each economy can benefit to some extent.

Another point is the dilution by time. At present, the most significant factor hindering economic development is debt. If the international economic environment cannot bring about a sufficiently large impact, then it can only rely on time to gradually consume it.

In summary, the economy cannot remain sluggish forever. Resting and waiting may be more appropriate choices for the time being.

Leave a Comment