As the market anxiously awaits this week's highly anticipated non-farm payroll report, the "Federal Reserve's favorite employment indicator" has already delivered a significant shock, reigniting expectations for a bold 50 basis point rate cut by the Fed in September.

Citi analysis points out that not only is the labor market weaker than before the pandemic, but it is also continuing to cool, and the rate of cooling may now be faster. If Friday's non-farm employment report confirms that the labor market is deteriorating, it is expected that the Federal Reserve will cut rates by 50 basis points in September and again by 50 basis points in November.

JOLTS job openings unexpectedly weaken, raising the probability of a 50 basis point cut

Data released on Wednesday showed that the number of job openings in the United States in July was 7.673 million, falling to the lowest level since early 2021, significantly below the expected 8.1 million, and the previous figure was revised down from 8.184 million to 7.91 million.

Breakdown data shows:

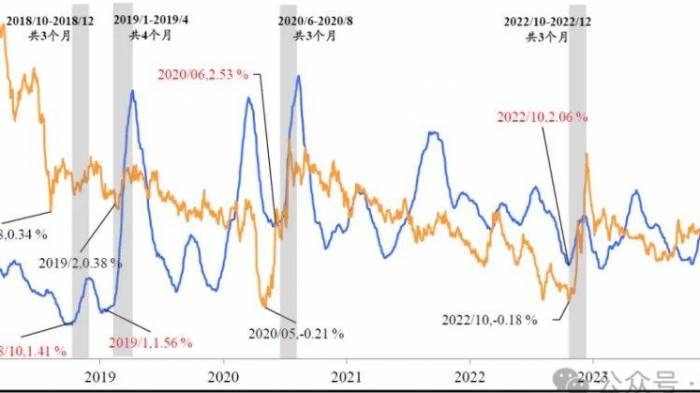

The ratio of job openings to the number of unemployed fell to 1.1:1, lower than the pre-pandemic ratio of 1.2:1, and more similar to the employment market conditions of 2018.

The hiring rate slightly increased from 3.3% to 3.5%, but it is still at a low level, comparable to 2014. Hiring in the leisure and hospitality sector was particularly weak, rebounding from an unusually low 4.5% in June to 5.5%. Government hiring rates plummeted, falling from 1.7% in March to 1.4% in July.

JOLTS job openings are labor market data highly watched by the Federal Reserve. After the weak data was released on Wednesday, market expectations for a 50 basis point rate cut in September increased.

According to the CME's FedWatch Tool, following the release of the JOLTS report, the probability of a 50 basis point rate cut once jumped to 50%, then fell back to 45%, compared to 38% the day before. Meanwhile, the possibility of a 25 basis point cut decreased from 62% the previous day to 55%.

25 or 50 basis points, Friday's non-farm "decider"?The day before, two major US PMI data also successively pointed to recession and stagflation, with growing concerns about a hard landing, the market entered the "bad data is bad news" pattern, and US stocks continued to fall, with funds once again pouring into the bond market.

The yield on the 10-year US Treasury fell for the second consecutive day, dropping to 3.75%, the lowest level since the beginning of this year and the lowest since July last year.

After the release of the JOLTS data, Citi analysts Andrew Hollenhorst and Gisela Hoxha said in a report that the US job market is on the brink of a more severe weakening:

Although the low layoff rate in July indicates that the labor market has not deteriorated sharply, the trend of decreasing job vacancies and declining hiring rates, coupled with a steady rise in the unemployment rate, shows that the job market is on the brink of a more severe weakening. It is expected that job vacancies will continue to decrease in the coming months, and the unemployment rate will rise more quickly.

Citi believes that if Friday's employment report confirms that the labor market is weakening, it is expected that the Federal Reserve will cut interest rates by 50 basis points in September and again by 50 basis points in November.

Leave a Comment