Despite Warren Buffett's cautious stance on Berkshire Hathaway's stock and the overall market, investors continue to buy the company's shares in large quantities, driving its valuation to multi-year highs.

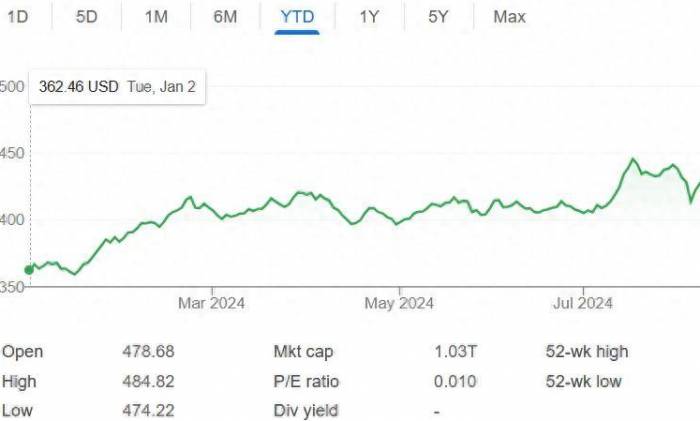

On Wednesday, Berkshire's Class A shares closed at $715,778, with little change, while Class B shares rose by 0.4% to $478.57, both setting new records. Since the company reported strong second-quarter earnings at the beginning of August, Berkshire's stock price has risen by more than 10%, and the increase this year has exceeded 30%, far outperforming the S&P 500's total return of 17%.

Berkshire's market value broke through $1 trillion last week, just before Buffett's 94th birthday. The current stock price is equivalent to 1.7 times its book value as of June 30, and it is expected to be 24 times the earnings per share for 2024, both higher than the average level of the past decade.

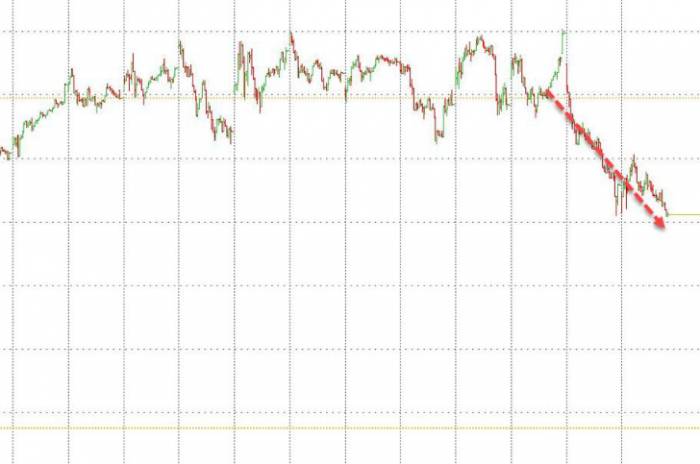

Despite the enthusiasm of investors, Buffett has been lukewarm about stock buybacks. The company only repurchased $345 million worth of shares in the second quarter, far below the $2.6 billion in the first quarter. This is the lowest quarterly buyback amount in five years. In the first few weeks of July, the company did not repurchase any shares.

Buffett is also cautious about the overall stock market. In the first half of this year, Berkshire net sold about $93 billion worth of stocks, mainly by significantly reducing its holdings in Apple. According to Barron's estimates, it may be close to $100 billion now.

Edward Jones analyst Jim Shanahan has a "hold" rating on the stock, believing that the current stock price has already reflected the company's positive factors. UBS's Brian Meredith and KBW's Meyer Shields have given target prices of $759,000 and $715,000 per Class A share, respectively, with "buy" and "market perform" ratings.

Despite potential earnings headwinds, such as interest rate cuts that may affect the yield on the company's huge cash reserves, Berkshire is still seen as a safe haven in market turmoil. The company holds an important position in the property and casualty insurance sector, which has recently performed well due to strong pricing.

Buffett emphasizes the company's intrinsic value rather than its book value. However, the book value has been supporting the performance of the company's stock since 1965 when Buffett took over. Assuming the current stock price remains unchanged, it is expected that by September 30, Berkshire's book value will increase by more than 2% from June 30, reaching about $430,000 per Class A share.

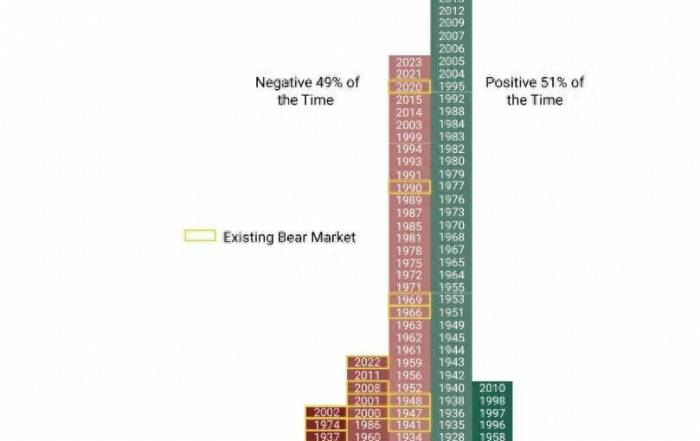

Although Berkshire has performed well in the past period, it remains uncertain whether it can continue to outperform the S&P 500 at the current high valuation. The succession issue of Buffett also adds uncertainty to the company's future.

Leave a Comment