On Wednesday, September 4th, Eastern Time, the Federal Reserve released the so-called "Beige Book," a national economic conditions survey report compiled by the 12 regional Federal Reserve Banks. The report indicated that in recent weeks, economic activity in most regions of the United States has remained flat or declined.

The Beige Book is published two weeks before the Federal Open Market Committee (FOMC) policy meeting. This edition of the Beige Book was compiled by the Cleveland Federal Reserve and summarized information collected up to August 26th, including anecdotes and comments on the business conditions in the districts of the 12 regional Federal Reserve Banks.

Economic activity was flat or declined in most regions, with consumer spending slowing down. The Beige Book stated that economic activity slightly increased in three regions, while the number of regions reporting flat or declining activity rose from five in the July report to nine.

Overall employment levels remained stable, but some companies only hired for essential positions, reduced employee working hours and shifts, or decreased their overall workforce through natural attrition (such as retirements or resignations). However, overall layoffs were infrequent. Wage growth was generally moderate, and there were increases in non-labor costs and the prices of goods, but the overall increases were kept within a slight to moderate range.

Consumer spending slightly decreased in most regions, whereas in the previous reporting period, consumer spending remained generally stable. Automobile sales varied by region, with some areas seeing an increase and others experiencing a slowdown due to high interest rates and elevated car prices.

Manufacturing activity declined in most regions, with two regions noting that this is part of an ongoing contraction in the industry. Reports on the residential and commercial real estate markets varied, but most regions reported a slowdown in home sales.

The situation for residential construction and the real estate market was mixed, but most regions reported weak home sales. Performance in commercial construction and real estate also varied.

Overall, economic activity in most regions is expected to remain stable or improve, but three regions anticipate a slight decline in economic activity.

The labor market was mixed, with businesses reluctant to expand hiring, but layoffs remained infrequent.In recent weeks, the overall employment level has remained stable, even with a slight increase. There has been a slight increase in the number of employees in companies across five regions, but some companies in certain areas have reduced their workforce by cutting shifts and working hours, withdrawing job postings, or through natural attrition such as retirements or resignations. However, layoffs remain rare.

Employers have become more selective, being less willing to expand their workforce, mainly due to concerns about insufficient demand and the uncertainty of the economic outlook. As a result, job seekers face increased difficulty in finding jobs, taking longer to secure employment. With the competition for workers diminishing and the employee turnover rate decreasing, businesses feel less pressure to raise wages.

Overall, wage growth has remained moderate, in line with the recent reports describing a slowdown trend. However, there is still a shortage of skilled workers and those with specialized skills, who have seen a larger increase in wages, and unionized workers have also experienced faster wage growth.

In recent weeks, there has been a slight increase in prices.

Overall, there has been a slight increase in prices recently, but the magnitude is not significant. Three regions reported that sales prices have only risen slightly. The non-labor costs of businesses (such as raw materials, etc.) are mostly described as a moderate to moderate increase, and have eased overall, although one region mentioned that these costs have risen slightly. Some regions mentioned that transportation and insurance costs continue to rise. In contrast, cost pressures for food, wood, and concrete have eased in some areas.

Looking ahead, many businesses believe that price and cost pressures may remain stable or further ease in the coming months.

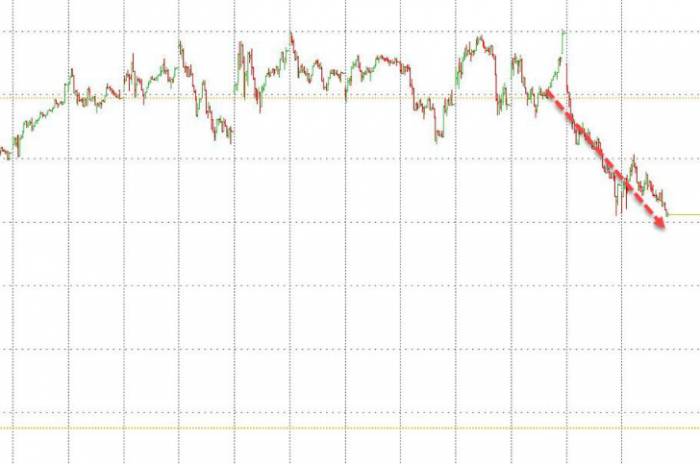

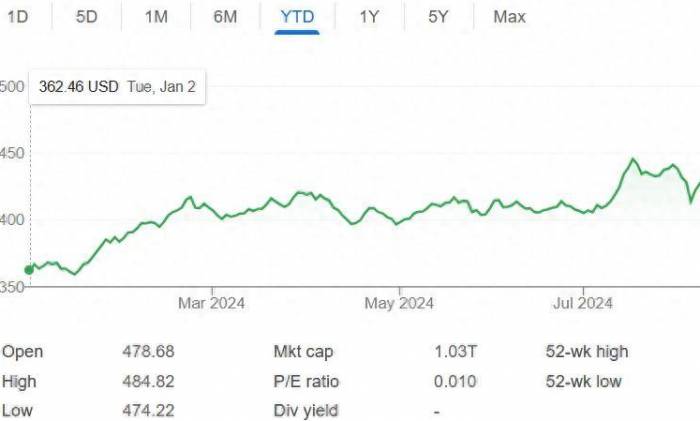

Following the release of the Beige Book, the US Dollar Index DXY continued to decline intraday. Major US stock indices also fell in the short term, with only the Dow Jones, which is composed of blue-chip stocks, rising. The yields on two-year and ten-year US Treasury bonds also fell in the short term.

Leave a Comment