It appears that this financial battle between China and the United States is finally coming to an end with our comprehensive victory. The Federal Reserve really can't hold on any longer; a rate cut in September is a foregone conclusion. After more than a year of consecutive interest rate hikes, the U.S. economy is indeed struggling, so the Federal Reserve is now almost playing with its cards on the table. Several high-ranking officials from the Federal Reserve have made dense statements that a rate cut in September is almost certain, and even three consecutive rate cuts within this year are anticipated.

American experts immediately stood up and said that if the Federal Reserve cuts interest rates, then trillions of dollars in assets will flow from the United States to China, and even the Chinese yuan to U.S. dollar exchange rate could soar by 10%.

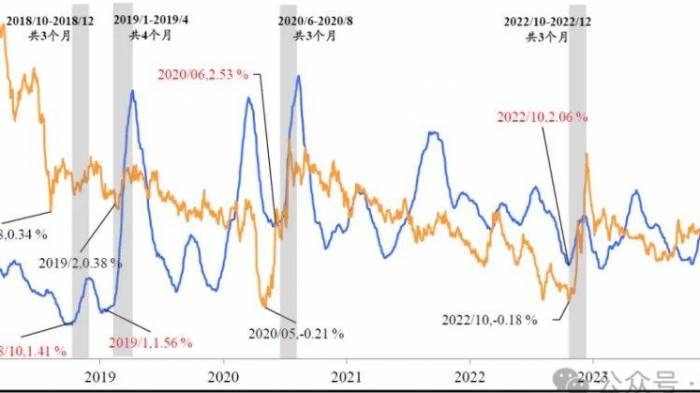

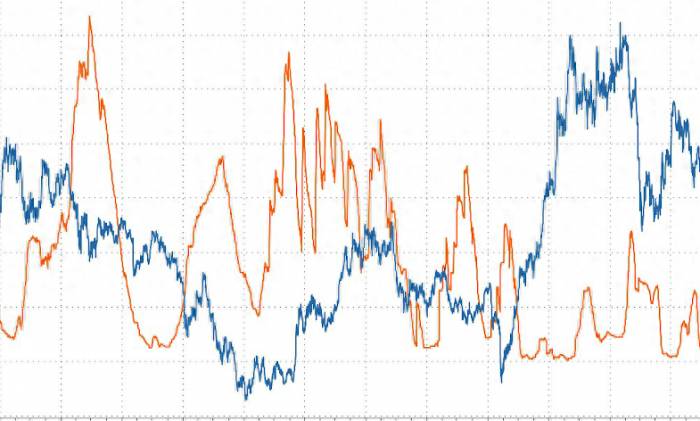

His judgment is not wrong because the Federal Reserve has not yet cut interest rates. It has merely hinted that a rate cut is imminent, and as a result, the Chinese yuan has been continuously appreciating against the U.S. dollar. So far, the yuan has already broken through the 7.1 mark, and it is possible that by September, the yuan will break through the 7 mark, which would be a high point in recent years. Of course, we feel that if the Federal Reserve really cuts rates three times within the year, it is entirely possible for the yuan to return to the recent high of 6.2 against the U.S. dollar. Why? Because hasn't the sharp devaluation of the yuan against the dollar over the past two years been caused by the interest rate differential between China and the U.S.?

Remember, just two or three years ago, the interest rate of the yuan was higher than that of the dollar. At that time, many people complained about why the interest rates for buying houses domestically were so high? Loan interest rates were often 5% or 6%, while U.S. loan interest rates were only around 3%. At that time, the deposit interest rate of the yuan was also higher than that of the dollar. However, in just two short years, the world has turned upside down. The Federal Reserve used more than a year to aggressively raise interest rates, causing the base interest rate of the dollar to soar from 0 to above 5.5.

Everyone thinks that if the deposit interest rate is 5.5, then how high would the loan interest rate be? Therefore, American homeowners have to spend more money to repay their mortgages, while on our side, we are now truly in a low-interest-rate era. You can't even get an interest rate above 2% for 3 or 5-year term deposits. Of course, with lower deposit interest rates, loan interest rates are also extremely low. Now, in some places, when you buy a house, the loan interest rate is not even 3%. Of course, the sudden change in the interest rate difference between China and the U.S. has also led to the devaluation of the yuan against the dollar. You think that originally, when you deposited money in the bank, you could get a 2% return with the yuan, and the return with the dollar was 0. Now, the return with the dollar is 5.5, and the return with the yuan is less than 2. Therefore, it is indeed the case that the U.S. interest rate hike has caused the world's wealth to concentrate in the United States, and has also caused the continuous devaluation of currencies like the yuan and the yen that do not follow the U.S. dollar's interest rate hikes.

However, it is clear that we have held on over the past year and more. After the U.S. dollar's interest rate hike, all major global economies had no choice but to follow suit because they were worried that if they didn't, their currencies would depreciate too much. But looking at the world, only we, when the U.S. dollar was raising interest rates, not only did we not follow suit, but we also went against the trend by lowering interest rates. Why do we have such courage? It is because, as we mentioned before, today the yuan's anchor is our huge industrial production capacity. When the yen was sharply depreciating against the dollar, although the yuan also depreciated against the dollar, it was not much.

Today, we are the world's factory and infrastructure mania. Almost all major global economies need to do business with us. To give the simplest example, our engineering team is currently building the Dechong Funan Canal in Cambodia. This 180-kilometer-long canal, with an expected construction period of four years, many people say that we might be able to complete it in eight or nine months. The strong industrial production capacity shown by China's infrastructure mania has attracted the attention of the world. So when the whole world needs your products, it will naturally use the yuan. The continuous increase in the global international payment share of the yuan, although there is a huge interest rate difference between us and the dollar, the depreciation of the yuan against the dollar is within a controllable range.

What about the United States? The U.S. interest rate hike is a move that hurts both sides. Although a large amount of funds flow back to the United States, the U.S. economy cannot develop due to the interest rate hike. You think for Americans, they don't have to do anything, as long as they deposit money in the bank, they can immediately get a return of more than 5.5%. So what money can flow into the real economy? This is also why over the past year, although there is a lot of money in the U.S. market, the stock market has been soaring, but the rental rate of commercial offices is declining, and the rent is also declining. This is because the United States is a false prosperity today, and its money has not flowed into the real economy.

The U.S. real economy is actually severely damaged, so the United States can't stand it anymore. The United States also realizes that if it continues to maintain high interest rates, the economy will collapse. In the competition between "high blood pressure and low blood sugar," the United States can't hold on anymore, and it still has to cut interest rates in September. So what impact will the U.S. interest rate cut have on our country's economy? A well-known American economist predicted that trillions of dollars in funds will flow back to China. Why? The reason is very simple. The reason why a large amount of money is now flowing to the United States is because the U.S. dollar interest is high, and everyone goes to earn this interest. When your interest is not so high, there will naturally be a large amount of funds looking for places that are more likely to make money. This place may be China.

On the other hand, a large amount of U.S. dollars flowing into China will naturally make the yuan rise rapidly. Experts believe that it is possible for the yuan to appreciate by 10% against the U.S. dollar in the next year. Today, one U.S. dollar can be exchanged for about 7.08 or 7.09 yuan. If we can appreciate by 10% within a year, we will basically reach the peak of the yuan in recent years, which is about 6.2 to 6.3 yuan per U.S. dollar. There are also predictions that due to the large amount of funds entering, it will make our country's economy suddenly become prosperous again. What does this mean?

In the past two years, we have been very worried about a word called deflation. What is deflation? It is the opposite of inflation. As ordinary people, we are naturally worried that if the market prices continue to rise and our wages do not increase, will our standard of living decline? However, for most economies, slight inflation is beneficial to economic development. On the contrary, deflation may not be a good thing. What situation will encounter deflation? It is when all the prices of goods on the market are falling, housing prices are falling, car prices are falling, meat prices are falling, and vegetable prices are falling. Many people say that it is not right, isn't the price falling a good thing? I can buy more material enjoyment with less money.The issue lies in the fact that when prices fall, people's desire to consume weakens. For instance, when it comes to buying a car, if you know for sure that a sedan selling for 100,000 yuan today might be priced at 95,000 yuan tomorrow and 90,000 yuan the day after, would you buy the car now? No, you would think that you should hold onto your money and wait for the price to drop further. If you don't buy and I don't buy, then the car manufacturers won't be able to sell their products, and they will have to lower their prices even more. Consequently, the market's wait-and-see sentiment will become even more intense. As this snowball effect continues, if everyone in society stops consuming and all businesses fail to make money, companies will have no choice but to further reduce product prices, leading to even less willingness to consume, and naturally, we won't earn enough wages.

Why is deflation so frightening? It's because it can freeze the entire economy. On the other hand, why inflation is, in a sense, positive, is because when prices rise, trading becomes active, everyone is willing to spend and consume, businesses can make money, all production lines are operating, companies will raise wages for their employees, and then the economic snowball will grow larger and larger. Therefore, over the past two years, we have been most concerned about deflation, and once the Federal Reserve lowers interest rates, a large amount of capital will flood into our country, making the market more active, and we will no longer have to worry about deflation.

Especially in the real estate market, over the past two years, real estate has entered a glacial period, which is honestly quite terrifying. No matter how many preferential policies the government or real estate developers introduce, such as reducing down payments and interest rates, even existing mortgage interest rates are lowered, the real estate market remains inactive. On one hand, falling housing prices mean more people can afford to buy homes, which is not a bad thing. However, on the other hand, most people in China own their own homes, and falling housing prices will undoubtedly lead to a reduction in our assets. Over the past two years, we have heard too many sad stories. Many young people have worked hard for 5 to 10 years, finally saving enough for a down payment, taking out a loan to buy a house, only to face pay cuts and layoffs, and being unable to make mortgage payments. They want to sell their houses, only to find that due to falling housing prices, after selling their homes, the money they get is not enough to pay off the bank loans, and they still owe the bank money, turning them into negative assets.

But if we look back at the years when the real estate market was booming, we didn't have such worries. Even if you lost your job, you could sell your house, and due to the appreciation of housing prices, you could still have a substantial amount of cash in hand. So indeed, housing prices are a double-edged sword. We hope that housing prices will fall so that ordinary people can afford to buy homes, but on the other hand, the economic downturn and falling housing prices over the past two years have really turned many people into negative assets, causing many to not only lose their down payments but also owe the bank money even after selling their homes.

So we have indeed seen that when housing prices fall abnormally, everyone is a victim. After the Federal Reserve lowers interest rates and a large amount of capital enters the Chinese market, many people say that our real estate market may become active again. Of course, after the Federal Reserve lowers interest rates and the yuan appreciates sharply against the dollar, our currency becomes stronger and more valuable, allowing us to purchase overseas goods more easily. In this financial battle between China and the United States, with the US raising interest rates and us lowering them, after holding out for more than a year, it seems that a decisive moment is approaching. The US may really not be able to hold on in September and will have to lower interest rates, which should be a significant positive for our country's economy.

Leave a Comment