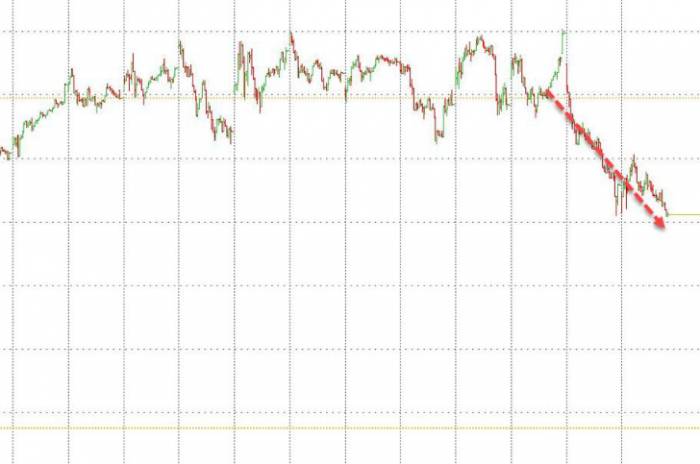

The Chinese yuan soared by over 1000 basis points overnight, with the onshore yuan-to-US dollar spot exchange rate rising from a low of 7.2440 to a high of 7.1524, and the offshore yuan-to-US dollar spot exchange rate climbing from a low of 7.2539 to a high of 7.1429, with increases of 916 and 1110 basis points respectively. This rare overnight surge of a thousand basis points might we finally be seeing the dawn of victory in this financial battle? Many had previously worried that one US dollar could be exchanged for 7.3 yuan, but in just one night, we've brought the exchange rate back to the 7.1 range, and we are now seeing the first light of victory in this financial war.

For some time, the yuan has been depreciating against the US dollar, primarily due to the continuous interest rate hikes by the Federal Reserve, which raised its benchmark rate from 0 to over 5.5% in a year. At the just-concluded Federal Reserve meeting, it was decided not to cut interest rates, despite rampant industry speculation that a rate cut would definitely happen in September. However, Federal Reserve officials have stated that this is mere speculation and that further discussion is needed to determine whether to cut rates in September.

On the other hand, while the US is not cutting rates, we have been doing so in earnest. Over the past month, the Loan Prime Rate (LPR) has been lowered, and major commercial and state-owned banks have all reduced deposit rates. Currently, it is nearly impossible to find a five-year fixed deposit rate exceeding 2%. Thus, it is clear that the interest rate differential between China and the US is widening. Normally, one would expect the yuan to depreciate further against the US dollar, but why have we been able to lift it by thousands of basis points overnight? There are reasons for this, and I believe the direct cause is that Japan has dealt a blow to the US from behind, while the fundamental reason is the strong economic fundamentals that ensure the stability of the yuan's value.

Why do we say that Japan has dealt a blow to the US from behind? For Japan, it is out of necessity. Over the past year, due to the US dollar's interest rate hikes without a corresponding move by the yen, the exchange rate gap between the two has been widening, leading to a significant devaluation of the yen against the US dollar. At its peak, one US dollar could exchange for over 162 yen, with the yen depreciating by more than 30% within a year, which is a substantial blow to the Japanese economy. Especially considering that, as we've mentioned in previous programs, Japanese exports have been decreasing and becoming less competitive. Therefore, even though the yen has depreciated by 30% against the US dollar, it has hardly helped Japanese exports.

On the other hand, as Japan is a typical country lacking in energy resources, the devaluation of the yen against the US dollar means that Japan has to spend more money to buy energy, resources, and food, leading to soaring prices and a struggling populace. Recently, the Japanese public has complained about the more than 50% increase in the price of the national dish, Yoshinoya beef bowl, in just a few years. Some Japanese politicians even tried to blame China, claiming that the rich Chinese buying large amounts of beef slices has made it unaffordable for the Japanese. However, the real reason is the devaluation of the yen against the US dollar, which requires more money to be spent on imports.

As a result, Japan could no longer withstand the pressure and ultimately chose to deal a blow to the US. How? First, the Japanese government has been selling off US debt aggressively in the past few months, with a total of over 100 billion dollars' worth of US debt sold. Why did the Japanese government do this? It had to sell off US debt to have enough funds to buy yen in the open market, thereby allowing the yen's value to rise. A key point for a currency to appreciate rapidly in the short term is the supply and demand relationship. When there is a lot of money in the market chasing and buying back yen, the yen exchange rate can go up. So, to prevent the yen-to-US dollar exchange rate from falling too badly, the Japanese government has really gone to great lengths, even willing to sell off US debt.

Of course, such a move has hurt the US. As everyone knows, the total amount of US debt has now exceeded 35 trillion dollars. The mounting US debt has led Treasury Secretary Yellen to frequently persuade various countries to buy more US debt, assuring them of its safety. It is clear that the Americans themselves are aware that as the US debt bubble grows larger, many countries will start to move away from the US dollar and reduce their holdings of US debt. However, the Americans did not expect that their most loyal ally would deal a blow from behind. Moreover, Japan is not the only one; from Canada to the European Union and the United Kingdom, almost all of the US's allies have begun to lower interest rates. These countries are different from Japan. In the past few rounds of aggressive US interest rate hikes, they followed suit because they feared being harvested. But now their own economies have been severely damaged by continuous interest rate hikes, and they want to wait for the US to cut rates before following suit. However, they can't wait any longer, it's too late, so they have no choice but to lower interest rates ahead of the US.

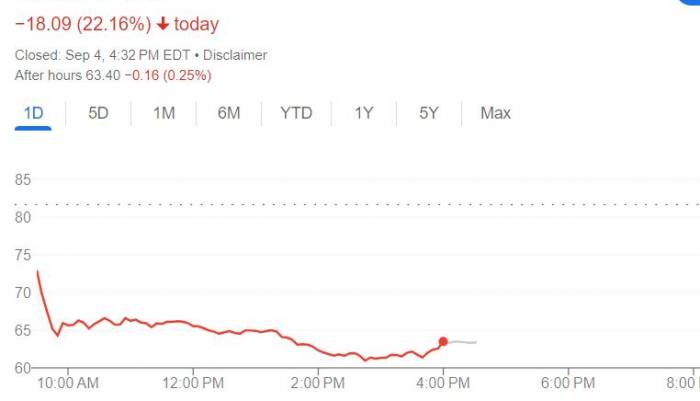

In conclusion, the overnight surge of the yuan is not just a one-off event but a result of a complex interplay of global economic dynamics and policy decisions. The actions of Japan and other countries in response to the US's monetary policy highlight the interconnectedness of the global financial system and the challenges faced by nations in maintaining their currencies' stability and economic growth.Of course, due to these several cuts, we have observed a sharp appreciation of the Japanese yen against the US dollar, which is naturally beneficial to the Chinese yuan. As Asian currencies, under the premise of the yen's surge, it implies a weakening of the US dollar index, which is naturally favorable for the appreciation of the Chinese yuan. On the other hand, just in the last couple of days, the United States has also released its economic data for July, with the increase in non-farm employment being significantly lower than expected, causing the US stock market to plummet in a collapse-like manner. Many people have said they have never seen some stocks fall so sharply. Yes, here we need to discuss the fundamental factors of a country's currency exchange rate, which is closely related to the economic fundamentals of that country. Is the US economic fundamentals good? Of course not. The Biden administration first printed a lot of money and then raised interest rates aggressively. These two self-harming moves have put the US economy in a precarious situation. On the surface, it seems to be thriving, but in reality, it is a mess.

Especially this year, which is also a US election year, we have seen the total US debt exceed $35 trillion, with the US economy on the brink of collapse, and more and more countries have started to move away from the US dollar. However, none of the candidates from either party have mentioned economic policies. Harris is talking about legalizing illegal immigrants, and Trump is talking about how to end the Russia-Ukraine war. It seems that the candidates from both parties have little interest in economic issues, or from another perspective, they are well aware that the towering debt of the United States today is not something that can be solved overnight. Trump did call for the return of manufacturing to the United States, and he even clamors daily to impose tariffs on countries around the world to enhance the competitiveness of American products. But let's not forget, what was the starting point of the global economic depression that swept the world? Wasn't it President Hoover's imposition of tariffs on European products, leading to a trade war between the US and Europe, a reduction in global demand, and then the arrival of the Great Depression?

So, if Trump's tariff policy is really implemented, we are really worried whether it will be a significant bearish factor for the US economy and the global economy. The internal economic chaos in the United States leads to the current strength of the US dollar, which is a false fire, it is the result of the Federal Reserve's interest rate hikes. And now, even though the Federal Reserve is tough on its lips, saying that it may not raise interest rates in September, the industry generally believes that the Federal Reserve cannot hold on, its high blood pressure cannot be sustained. By September, if it does not lower interest rates, the entire US economy will be affected. On the other hand, the industry generally believes that by September, the United States will not be able to hold on, the United States will surrender, and the United States will lower this interest rate. Of course, once your interest rate is lowered, your US dollar will become weaker, and your exchange rate against the global mainstream currencies will fall further, so this is determined by the economic fundamentals.

On the other hand, as we have said in our previous programs, for more than a year, although the United States has been raising interest rates, neither China nor Japan has followed suit, but the situation of the yen has been very bad, with a plunge of more than 30%. The Chinese yuan has also fallen, but we have not fallen so much, we have only slightly fallen a bit, why? The fundamental reason is that we are not worried about the widening of the exchange rate gap, our economic fundamentals are good, we are the world's factory today, we are the world's demons, we produce a variety of industrial products for the world, our products can be exported, so our Chinese yuan will be strong.

In the past, the anchor of the US dollar was oil, but today the anchor of the Chinese yuan is our strong industrial production capacity. Countries around the world need the Chinese yuan, why? It wants to do business with you, it knows that holding the Chinese yuan can buy goods from you, and Chinese goods are of good quality and low price and sold all over the world, so our strong industrial production capacity is the guarantee of the strong value of the Chinese yuan. Therefore, although China and Japan have not followed the US interest rate hikes, and even while Japan's interest rates have remained stable, we have lowered interest rates several times in the past year, but the yen has depreciated by 30%, and we have only depreciated by about 5%.

And once there is a slight change, once the market believes that the Federal Reserve has to raise interest rates in September, the value of the Chinese yuan will immediately rise, why? Because in the final analysis, how your country's currency exchange rate is, the key is still in your economic fundamentals, the key is whether countries around the world recognize your economy, whether they recognize your currency. This time, Japan stabbed the United States, and the yen's exchange rate against the US dollar rose sharply, and we also rose with the tide, and by September, when the Federal Reserve really can't hold on, and really lowers interest rates, then the Chinese yuan against the US dollar will have another big rise. For the Chinese people, an increase in the exchange rate of the Chinese yuan is equivalent to an increase in the wealth in our hands. Going abroad for tourism, studying abroad, and purchasing overseas goods can be done with less money and more things.

Leave a Comment