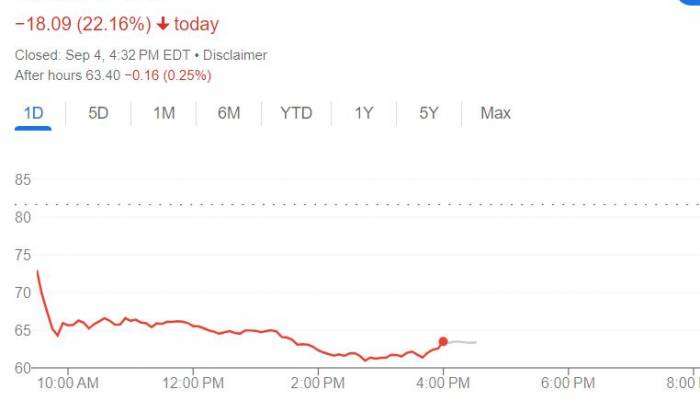

On September 4th, the three major U.S. stock indices continued to decline at the opening, with NVIDIA's opening drop reaching 2%. Just the day before, the three major U.S. stock indices experienced a significant drop, with the NASDAQ Composite falling by 3.26%. NVIDIA's stock price plummeted by 9.53%, resulting in a market value reduction of approximately $279 billion, setting a record for the largest single-day market value decline in U.S. stock history.

The Japanese and South Korean stock markets also faced declines on the 4th. The Nikkei 225 Stock Average closed down by more than 1,600 points, with a drop of 4.24%. The South Korean Composite Stock Price Index closed at 2,580.8 points, down by 83.83 points, a decline of 3.15%.

Expert Analysis | Concerns Over U.S. Economic Prospects Lead to a September "Black Start" for U.S. Stocks

So, why did semiconductor stocks, represented by NVIDIA, experience such a significant drop? Why have U.S. and Japanese and South Korean stocks declined recently?

The "Black Start" for U.S. stocks in September, from a macro perspective, is mainly due to weaker-than-expected U.S. manufacturing data. The U.S. August Manufacturing Purchasing Managers' Index (PMI) has been in a contraction range for five consecutive months, once again raising concerns about the U.S. economic outlook.

NVIDIA's product development issues and the receipt of antitrust investigations further suppressed NVIDIA's stock price, leading to a decline in the entire chip sector.

NVIDIA Faces Product Issues and Antitrust Investigations

Wu Chaozhe, Director of the Securities Research Institute at CITIC Construction Investment Securities: The research and development and production of NVIDIA's new generation of products have been delayed due to technical reasons, and the market is also concerned about this. Judging from supply chain news, there have been minor adjustments to the product before the final quality delivery, which has affected the timing of NVIDIA's new product contribution to revenue. The market is worried whether there will be new problems during the transition from old to new products, thus having a substantial impact on NVIDIA's performance.

Additionally, there are news reports that NVIDIA received a notice of antitrust investigation from the United States after the market closed, investigating whether there is unfair competition in the current sales process. According to our judgment, past such matters are usually handled in two ways: one is the division of the business, and the other is a fine. The decline in NVIDIA's stock price after the market close also reflects the market's concern about the subsequent related impacts.

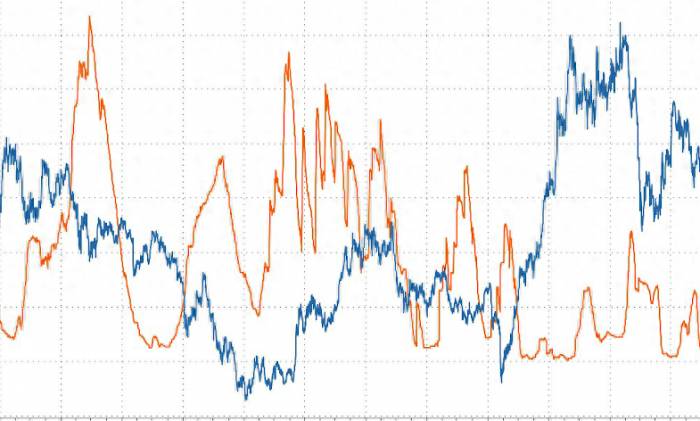

The Plunge in NVIDIA's Stock Price Spreads to Japanese and South Korean Semiconductor StocksThe significant drop in NVIDIA's stock price has triggered a chain reaction in Japanese semiconductor-related stocks, further leading to a panic decline in the stock markets of Japan and South Korea.

Wu Chaozhe, Director of the Research Institute at CITIC Construction Investment Securities: Today, the chip stocks in Japan, South Korea, and Taiwan, which are related to NVIDIA as contract manufacturers and part of the related industry chain, such as those in the fields of optical communication, servers, and raw materials, have also been affected to some extent. In addition, the Netherlands has recently indicated that it may tighten the export of chip equipment. The impact on the related industries, especially the semiconductor industry, I personally feel is relatively indirect, as the semiconductor equipment mainly affects the upstream of the industry chain with advanced processes.

AI industry falls short of expectations, and the approaching US interest rate cut amplifies concerns.

Wu Chaozhe, Director of the Research Institute at CITIC Construction Investment Securities: In summary, the underlying driving force behind this round of global technology stock growth still comes from the AI industry. However, currently, the output of the entire AI industry chain is somewhat below expectations, and in the short term, it is also affected by the capital outflow brought about by the expectation of US interest rate cuts, which further amplifies the concern about the industry, and is a major cause of the decline in overseas technology stocks this time.

Leave a Comment