What is the most difficult aspect of stock trading? Peony believes that the hardest part might be selling when the market is buzzing with noise and holding onto a positive outlook for the future when everyone else is bearish. This is because stock trading is a game of mentality and emotions; if what all investors think is an opportunity is not really an opportunity, and when all investors anticipate risks, it's not really a risk.

Currently, many people believe that the three major stock indices will fall, and the short-term Shanghai Composite Index is also continuously adjusting, with bearish sentiment following the trend. But in 2021, when everyone was bullish, did the stock market rise back to 6,000 points? When A-shares were at 2,780 points and everyone was bearish, how much further could it have fallen? This is a question worth pondering.

Looking back at 2007, 2015, and 2019, A-shares also rose significantly when the market was generally bearish. The current price-to-earnings ratio of the Shanghai Composite Index is already below 13 times, which is lower than the valuation before the bull markets in the previous years. A-shares will not fail to rise. The future market trend, when analyzed in the short term, appears to be falling, but when analyzed in the medium to long term, it presents opportunities.

Everyone should mentally prepare in advance; the stock market may very well repeat the history of 2008.

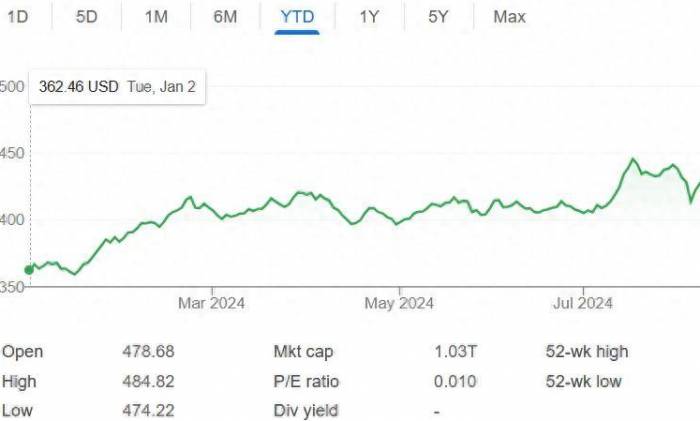

Let's discuss one detail: after the significant rise in February of this year, the stock market in May experienced a high and then fell back, a trend that has not been unheard of in history. It happened in 2019, and subsequently, the stock market began a significant rise in 2020. This year has already seen a surge in positive news, yet A-shares have not continued to rise; is it that there are no investors buying?

This year, equity ETFs have invested over 500 billion yuan in the stock market, with purchases of the CSI 300 exceeding several hundred billion. Consider why institutional investors are buying; if they were bearish on the stock market, they would not be buying. In other words, institutional investors are looking at a future rise, with A-shares at 2,800 points, which could be a historical bottom over one or two years.

Especially in the short term, high-dividend sectors are falling, while thematic hot spots are rising. With the Shanghai Composite Index below 2,800 points, thematic hot spots have already begun to bottom out and climb one after another, which also indirectly reflects that A-shares have shown signs of being unable to fall further.

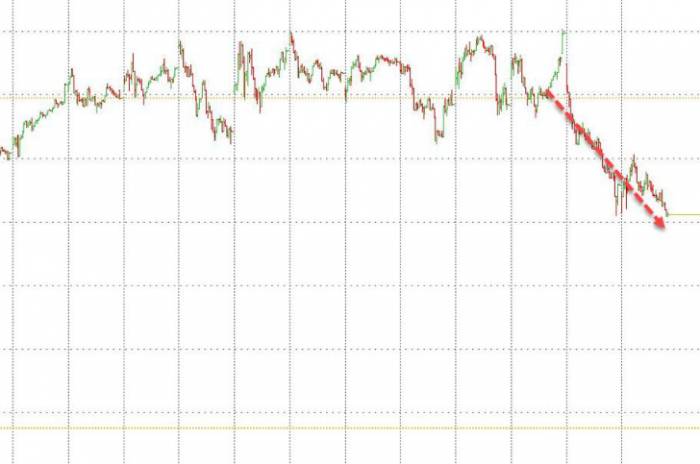

Peony predicts that everyone should mentally prepare in advance; the stock market may very well repeat the history of 2008. However, history will not simply repeat itself. Peony's analysis suggests that this year's stock market is a scaled-down version of 2008, and the Shanghai Composite Index will be about right if it falls a bit more.

From the significant drop in January, to the rise in February, the high and then the fall back in May, and the deepening divergence between the Shanghai Composite Index and the ChiNext board in September, leading to strong volatility in the ChiNext board. Have you noticed that this year's stock market is too similar to 2008, and also very similar to 2019?If this year's stock market follows the same trend as in 2008 and 2019, but on a smaller scale, then the A-share market will be brewing a significant uptrend. The rise in 2009 and the similar scaled-up rise in 2020 will be mirrored.

More importantly, this year's market trend will only last for a few months, and the stock market tends to dip a bit by the end of the year. Under the new delisting rules next year, some companies may very well delist. Institutional investors have purchased tens of billions of yuan in ETFs, and they will not allow the A-share market to fall below the 2635 point level. The rise in September and October will be even better.

If the stock market does not fall below the 2635 point level, the Shanghai Composite Index's decline is expected to be met with a strong counterattack when it drops by 100 to 200 points. It is estimated that there will be a wave of increases in September and October to cope with the market fluctuations at the end of the year, and then a significant rise will commence next year.

Additionally, with the recent release of the semi-annual reports, after the end of the second quarter this year, the stock market did not rise in May and June, and it has been falling for almost four months consecutively. Even in a falling market, the performance of many listed companies is evident. Good performance and good companies should also see an increase.

If there is no increase, after November, with the increased number of funds from year-end sellers, should the market continue to fall for seven or eight months? There is no stock market that only falls and never rises.

In summary, the analysis suggests that while the short-term market trend is expected to decline, the A-share market has the potential for significant movements in September, where a drop of 100 to 200 points could trigger a bottoming and climbing trend. This is the most suitable month for the year and a time when the A-share market is at a significant low, with at least two rebound trends expected.

Leave a Comment