Let's talk about the "Sahm Rule" that has been a hot topic across the internet in recent days.

This is an economic indicator proposed by Federal Reserve economist Claudia Sahm, designed to predict whether the US economy has fallen into a recession. The definition is not complicated; in simple terms: "If the three-month moving average of the unemployment rate rises by at least 0.5 percentage points from its low over the previous 12 months, it indicates that the US economy has entered a recession."

Why has this rule suddenly gained popularity recently?

There are two reasons.

First, it's really accurate. Since its proposal, the Sahm Rule has accurately predicted the arrival of recessions before the last ten economic crises.

For example, during the 1973-1974 recession, the real-time indicator of the Sahm Rule reached a level of 0.57 and continued to rise, perfectly aligning with the economic downturn. Also, during the 2008-2009 recession, the real-time indicator of the Sahm Rule first exceeded 0.50 in April 2008 and remained above the warning line for two years, which is essentially consistent with the duration of the economic recession.

Second, the wolf is at the door. The US unemployment rate in July 2023 was 3.5%, and the newly released unemployment rate for July 2024 has reached 4.3%, an increase of more than 0.5 percentage points year-on-year. This has brought the three-month moving average of the unemployment rate to the level that triggers the Sahm Rule.

This means that a recession in the US economy is about to begin.

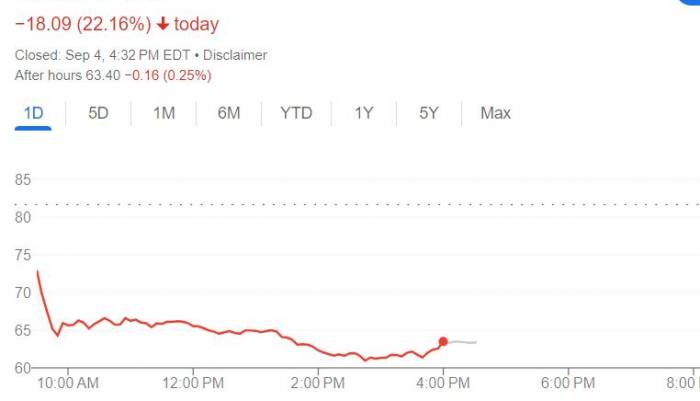

The international market immediately responded strongly.

On August 5th, global stock markets experienced a Black Monday, with a simultaneous plunge.The South Korean Kospi index closed down 8.77%, marking the largest single-day drop since late October 2008. The South Korean KOSDAQ index plummeted by 8%, triggering a circuit breaker mechanism, and trading was suspended for 20 minutes.

The Australian S&P/ASX 200 index closed with a heavy loss of 3.7%, the Singapore Straits Times Index fell nearly 5% at one point, and the Indian stock market fell more than 3% at one time.

The cryptocurrency market also suffered a heavy blow, with the prices of mainstream cryptocurrencies such as Bitcoin and Ethereum falling sharply. Bitcoin's intraday drop exceeded 10%, and Ethereum's drop was even more than 20%.

The most severe drop was in Japan, where the Nikkei 225 index plummeted by more than 12%, setting the record for the largest single-day drop in history, with multiple circuit breakers being triggered during the trading session. The Tokyo Stock Price Index also suffered a heavy blow, plummeting by more than 12%, and together with the Nikkei 225 index, they set the record for the largest single-day drop in history.

Of course, there must be another reason behind such an outrageous drop in Japan.

For a long time, due to the extremely low interest rates of the yen, it has essentially become a tool for speculators to arbitrage globally. Many speculators borrow yen to invest and then massively purchase high-yield assets, such as U.S. Treasury bonds and the stock market. However, on July 31, the Bank of Japan suddenly announced a rate hike policy, raising the policy rate from -0.1% to 0.25%. The intention was to narrow the interest rate gap between Japan and other major economies and to support the shaky yen exchange rate.

But the market doesn't think so. The profit space for previous carry trades was compressed, so speculators began to sell assets and repay yen loans, thereby intensifying market selling pressure.

Moreover, it is even more embarrassing that overseas funds did not flood into the Japanese market as expected. Who knows what kind of policy adjustments the Bank of Japan will make in the future? After all, they have been maintaining low interest rates for decades, and all institutions, companies, and individuals are playing in it like fish in water. And speculators will inevitably be more inclined to wait and watch or withdraw funds in an uncertain policy environment.

This is the power of the U.S. economic recession. Before the sneeze has even been sneezed, the global financial market has already experienced the feeling of a roller coaster.

Sister Sam herself quickly came out to clarify that the recent rise in U.S. unemployment is different from the past, mainly due to the large influx of immigrants increasing the supply of the labor market. In addition, the traditional U.S. unemployment rate statistics will regard all people included in the labor market as potential employees, without considering their employment stability and quality of employment.Thus, when a large influx of new immigrants increases the labor supply, even if their unemployment rate is higher, it can lead to the overall unemployment rate appearing better than the actual situation.

However, the market is not buying her explanation at all. The Federal Reserve has maintained high interest rates for such a long time, yet the economic data remains weak. Although Federal Reserve Chairman Powell has hinted that it is highly likely that the first interest rate cut will be initiated in September, there is still more than a month to go, and how to deal with the continuous significant economic downturn?

It's no wonder the market is so tense; the impact of the United States' finance on the global economy is just too significant!

Take the subprime mortgage crisis as an example.

This was originally a mess created by the U.S. real estate market, but it triggered a global financial crisis.

At that time, economic activities worldwide were severely impacted, with economic growth slowing down or even turning negative. A large number of businesses went bankrupt, and the unemployment rate soared sharply. It is estimated that the subprime mortgage crisis directly led to tens of millions of people becoming unemployed worldwide and hundreds of millions falling into poverty.

Europe was hit the hardest, with European banks holding a large amount of financial derivatives related to U.S. subprime mortgages, resulting in heavy losses. In addition, the fiscal stimulus measures taken by European governments to cope with the crisis also led to the outbreak of the sovereign debt crisis. This European debt crisis further exacerbated the economic difficulties in Europe, making the situation even worse.

The Middle East, which seems economically independent, is also not having an easy time. The subprime mortgage crisis led to a slowdown in global economic growth and a decrease in energy demand, indirectly affecting the oil exports and economic growth of the Middle East. Moreover, the financial markets and institutions in the Middle East were also impacted to varying degrees. Some Arab countries even experienced several regional revolutions and unrest due to economic recession, rising unemployment rates, and intensified social conflicts.

The essence of the subprime mortgage crisis was the securitization of mortgage loans, followed by the spread of debt risk worldwide.

Let's illustrate with a specific example:Suppose there is a small town where the residents want to buy houses but don't have enough money on hand, so they apply for subprime mortgages from the local bank (this is the "subprime loan"). These loans are typically offered to those with poor credit records or unstable incomes. To earn more profits, the bank decides to issue a large number of such loans.

Over time, more and more residents have obtained subprime loans and purchased homes. However, due to the limited repayment capacity of many borrowers, these loans begin to accumulate risk. If many people are unable to repay at the same time, the bank will suffer, with significant losses.

To transfer and disperse these risks, the bank decides to package these subprime loans into a "mortgage basket" (i.e., an asset pool), and transform the loans in this basket into a type of security that can be traded in the market—professionally known as "mortgage-backed securities" (MBS). These securities are divided into different tiers, with senior and subordinate levels, with senior investors having priority in compensation.

Next comes the sale and global spread of securities. Banks begin to sell these MBS globally. Investors come from all over the world, including banks, insurance companies, pension funds, and individual investors from other countries. These securities offer high returns, and with large banks backing them, investors are basically scrambling to buy.

Over time, due to an economic downturn, more and more people in the town begin to be unable to repay the subprime loans. This leads to an increase in the default rate in the mortgage basket, which in turn affects the value of the MBS. Senior investors can still accept losses, while subordinate investors are basically wiped out.

More importantly, because these MBS have been sold all over the world, the town's debt problem quickly evolves into a global financial crisis.

In the current U.S. financial system, there are still similar practices, which are nothing more than strengthening some regulations on mortgage securitization. For example, requiring financial institutions to conduct stricter risk assessments and information disclosures during the securitization process, ensuring that investors can fully understand the risk status of the underlying assets.

But once the U.S. economy itself is in recession, who would still care about regulating this and that. Anyway, the global market pays the bill, and as long as it's not me, the more fun I can have, the better.

Of course, our country will certainly make the utmost effort to resist, such as why the U.S. was dragging the whole world to raise interest rates not long ago, but China has been continuously cutting interest rates, which is a strong financial counterattack.

The pressure faced in this situation is simply unimaginable.On a macro level, I won't delve into details, but let's discuss a minor matter that can reveal the pressure a country is under.

Non-conversion of trade income. Although illegal, it's really hard to monitor businesses to prevent this practice.

This refers to the situation where foreign trade companies, after receiving foreign exchange income, choose not to convert it into their local currency but instead retain it in foreign exchange accounts or hold it in other forms.

When the foreign exchange rate appreciates relative to the domestic currency, businesses holding foreign currency can profit from the exchange rate fluctuations. For instance, if a company retains its income in US dollars when the dollar appreciates, it will receive a larger amount of local currency when these dollars are eventually exchanged.

However, for a country, if a large number of foreign trade companies opt not to convert their income, it will inevitably lead to a decrease in the nation's foreign exchange reserves. Insufficient foreign exchange reserves will limit the central bank's operational space in the currency market and increase the difficulty of implementing monetary policy. In other words, the financial defense front will face a crisis of inadequate firepower.

So, if the US really lowers interest rates in September, it would indeed alleviate a lot of pressure for us.

But if, as predicted by the "Samuelson Rule," the US economy begins to decline, that would be troublesome. The impact of the US financial sector on the global economy is simply too significant, and a global economic crisis resulting from an economic downturn would inevitably affect everyone.

Wealthy individuals, of course, have little to worry about; with substantial resources, they can simply clean out their rooms and have enough to live comfortably for a while.

The key is what we ordinary people should do. I strongly recommend the following actions:

1. Exercise caution in investments, halt any additional investments, and withdraw from the stock market, funds, or any other investments you can. If you indeed have some spare money and want to engage in some activities, I suggest diversifying investments, with gold being the most recommended.Two, refuse to be in debt. One must develop a thicker skin; if the husband wants to borrow money, say the wife disagrees, and if the wife wants to borrow money, say the husband disagrees. Keep a tight grip on cash in one's own hands.

Three, do not be enticed by the deposit interest rates of small banks; deposit money in state-owned large banks. During times of economic crisis, state-owned large banks are the only objects of key support.

Four, cease extravagant consumption, especially of luxury goods. Avoid changing cars unless absolutely necessary. The same goes for houses; never leverage up to get on the property ladder.

Additionally, it is imperative to eliminate all unreasonable spending, such as concerts, high-quality tourism, birthday parties, impulse purchases, in-game spending, and so on, all of which should be cut.

Lastly, if possible, it would be best to also eliminate any aversion to work.

Leave a Comment