First, the conclusion: No.

On July 30th, the National Debt Clock located in Manhattan, New York, USA, displayed the total public debt of the United States: $35.002 trillion. Compared to the $32.04 trillion announced by the U.S. Department of the Treasury on June 15, 2023, it has expanded by approximately $3 trillion.

$35 trillion, according to calculations by the Peter G. Peterson Foundation in the United States, if these huge debts are distributed among the American people, it is equivalent to each person being in debt by nearly $104,000.

Of course, facing such a massive debt, thinking about repaying the principal is out of the question. It's all about rolling issuance, new debt to pay off old debt, with no pressure to repay the principal. But the interest is a headache, which is actually the implicit constraint of the national debt. Otherwise, if you could just expand the scale of the national debt however you wanted, wouldn't that be a bug in economics?

Modern Monetary Theory (MMT) also mentions this point, that the issuance of currency is not constrained by government budgets, but is constrained by inflation. That is, the government debt ceiling can be expanded indefinitely only if it does not trigger inflation.

And if even the interest cannot be paid, that is completely disregarding the risk of inflation and directly starting the printing press.

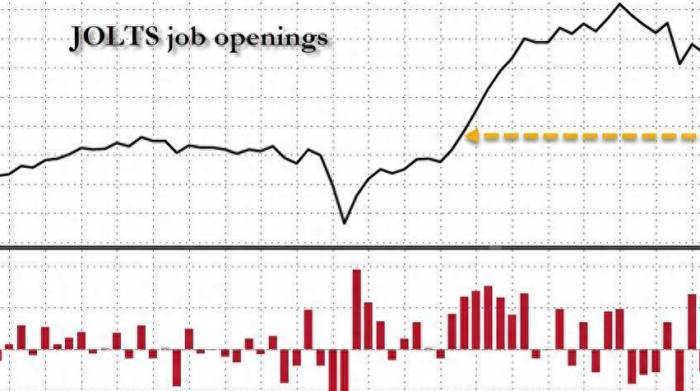

So let's first look at the situation of the United States repaying the interest on its debt.

U.S. Treasury securities come in various terms, including short-term (such as 1 month, 3 months, 6 months, 1 year), medium-term (such as 2 years, 3 years, 5 years, 7 years, 10 years), and long-term (such as 20 years, 30 years). The interest rates of Treasury securities with different terms will also vary, with long-term Treasury securities typically having higher interest rates than short-term ones.

In addition, the average interest rate level of U.S. Treasury securities is also a relatively complex and dynamically changing data, as it is influenced by a variety of factors, including the global economic situation, monetary policy, inflation expectations, market supply and demand relationships, etc. Therefore, predicting a very accurate average interest rate value is not very likely.

However, based on publicly released information and statistical data, we can roughly estimate the average interest rate of U.S. Treasury securities over the past 10 years, which is about 3%.That is to say, if the interest rate level remains constant in the future, then for the 35 trillion dollars of national debt, the U.S. government would have to pay an interest of 1.05 trillion dollars each year. According to information released by the U.S. Department of the Treasury, the total fiscal revenue of the United States for the year 2023 is approximately 4.4 trillion dollars. Within fiscal expenditures, rigid items such as social security, health, federal medical insurance, and defense occupy a significant proportion.

Thus, there is very little room left for interest payments. It can be said that 1 trillion dollars in interest should be the limit that the U.S. government can bear; any higher, and they might have to consider alternative methods.

As a result, many people might think this is too serious, especially since China still holds nearly 800 billion dollars in U.S. Treasury bonds. What if the Americans act without honor, wouldn't all this money go down the drain?

In fact, such concerns are largely unnecessary.

National debt is divided into domestic debt and foreign debt.

Domestic debt, also known as internal debt, is government debt denominated in the country's own currency. For example, the treasury bonds, local government bonds, financial bonds, and corporate bonds issued in our country all fall under domestic debt.

For a country, domestic debt is not really debt. This is primarily because the government, as the issuer of its own currency, can theoretically alleviate the repayment pressure of domestic debt by adjusting monetary policy (such as increasing the money supply). Additionally, when the government issues national bonds, it is essentially leveraging the credit value of the currency to raise funds without needing to put any tangible wealth as collateral.

To put it more bluntly, from an essential perspective, there is no issue of repaying or not repaying domestic debt. After all, it's a matter within one's own household; if necessary, laws and regulations can be changed, fiscal policies can be adjusted. If all else fails, isn't there a printing press under the desk? With a simple start-up, all domestic debts can be made to vanish in the blink of an eye.

However, the risks associated with foreign debt are much greater.

Firstly, the repayment of foreign debt must be made in the corresponding foreign currency. If the government's foreign exchange reserves are insufficient or the balance of payments deteriorates, the risk of default on foreign debt will correspondingly increase. Moreover, the repayment of foreign debt is also subject to the supervision and constraints of international creditors; with the stick in someone else's hand, one cannot help but feel anxious.Second, the impact of exchange rate fluctuations is substantial. This is also a major risk faced by external debt. When the local currency depreciates, the cost of repaying external debt denominated in foreign currency increases, thereby inevitably increasing the pressure to repay. Moreover, exchange rate fluctuations can also affect import and export trade. If not handled properly, the money earned in previous years can be completely lost within a few months or even days.

Third, the risks of the international financial market. The issuance and repayment of external debt are closely related to the international financial market. Any fluctuations in the international financial market, such as changes in interest rates, capital flows, etc., can have a significant impact on the financing costs, repayment ability, and market value of external debt. In addition, unexpected events in the international financial market, such as financial crises, political turmoil, etc., may also lead to an increased risk of external debt default.

And once the external debt cannot be repaid, that's trouble.

Take Argentina, for example. This is the sovereign state with the most external debt default incidents in the world. It has little rice at home but insists on implementing high welfare policies to win votes. High welfare requires a lot of money, but Argentina's economy is highly dependent on the export of bulk commodities (such as agricultural products, minerals, etc.), and the economic structure is very single. Any fluctuation in the international market can immediately break the income.

So borrowing external debt is basically the only means for the Argentine government. When the scale of debt exceeds the government's repayment ability, a debt crisis will inevitably occur.

From the debt crisis in the 1980s to the large-scale default in 2001 and the multiple small defaults in recent years, Argentine politics has always been in a vicious cycle:

Debt crisis leads to a sudden increase in government fiscal pressure -> The government has to take austerity measures to reduce expenses -> Reducing expenses requires lowering the level of social welfare -> The public is dissatisfied and promotes regime change -> The new government takes office -> Adopts high welfare policies to win the hearts of the people -> Borrows new debt to repay old debt -> A debt crisis occurs.

External debt is not like internal debt. If it cannot be repaid, it has to be compensated with tangible wealth.

In order to raise funds, the Argentine government has to sell some state-owned enterprises to foreign investors in the form of privatization. And among these assets, there are enterprises and facilities in key areas such as energy, transportation, and communication.

The lifeline of the country is actually held in the hands of others.Even after these high-quality assets were sold off, the Argentine government still had its eyes on the gold reserves. In June of this year, Argentine President Milé secretly shipped 62 tons of gold to the UK to use as collateral for a dollar bridge loan. It was ultimately a report in the Spanish newspaper El País that brought this matter to light.

How tragic, a country that is exceptionally endowed with mineral resources, water resources, and agricultural resources, and yet it has managed to deplete its own treasury.

This is where the immense risk of foreign debt lies.

However, for this risk, the United States does not have to worry at all.

There was once a U.S. congressman who asked former Federal Reserve Chairman Alan Greenspan the following question: "The U.S. debt is growing larger and larger, and it seems impossible to repay it. What if there is a debt crisis in the future?"

Greenspan did not answer directly at first, but instead talked around various economic theories. Later, when he realized he could no longer evade the question, he revealed the truth: "U.S. Treasury bonds are denominated in U.S. dollars. If we really can't pay them back, we can just print more money."

This is the fundamental reason why the article begins with "The U.S. government debt has exceeded 35 trillion, and even the interest is almost unaffordable, yet it will never default in the future."

The U.S. dollar is the world's currency, and the Federal Reserve is the world's central bank, so U.S. debt is essentially domestic debt. There is no issue of not being able to repay domestic debt. Countries and institutions around the world hold a large amount of U.S. dollars and U.S. dollar assets for international trade, reserve assets, and as a hedge, among which U.S. Treasury bonds are a very important pool. The U.S. monetary policy and fiscal policy are indeed the world's monetary and fiscal policies.

Of course, Greenspan's mention of printing money is mainly an expression of the safety of U.S. debt. In reality, the U.S. would not easily start the printing press.

Everyone knows that banknotes themselves have no value. The real value lies in the tangible industrial and commercial products and the demand for purchasing them. If there is large-scale printing of money, and the production capacity and demand cannot keep up, then the inevitable consequence would be hyperinflation.Although the U.S. printing press corresponds to global inflation, other countries will inevitably take countermeasures to some extent, as no one wants to be exploited without reason.

Take our country, for example. As the only country in the world that possesses all industrial categories listed in the United Nations Industrial Classification, we lead the world in the production of more than 220 of the 500 major industrial products. Therefore, the purchasing power of the U.S. dollar largely depends on our production capacity.

Moreover, China implements strict exchange rate controls. When the U.S. dollar is massively devalued, we can choose to completely ignore it, or even appropriately appreciate the value of the yuan to stimulate exports and curb imports.

In this scenario, the U.S. would painfully observe inflation in some areas and minimal impact in others, thereby significantly reducing the power of the dollar.

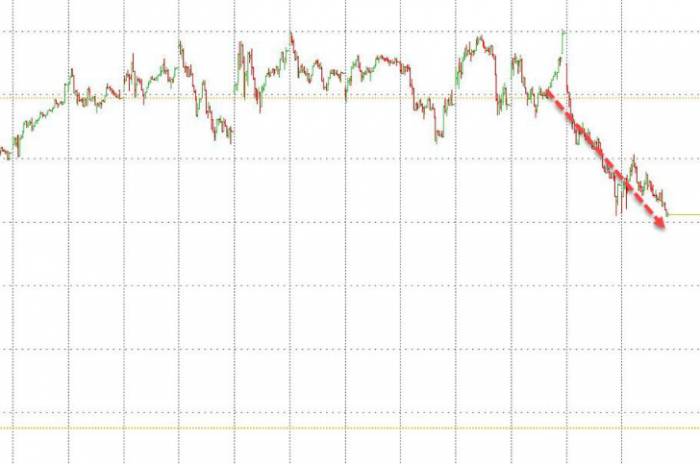

Thus, facing the huge interest payment pressure, printing money directly is definitely the worst strategy. The best solution is to lower interest rates. For a $35 trillion national debt, an interest rate of 3 percent amounts to $105 billion per year. If this rate is reduced to 1 percent, the annual payment would only be $35 billion, and the pressure would vanish instantly.

Japan has done exactly that. Since the 1990s, the Japanese economy has long faced deflationary pressures and weak economic growth. To stimulate the economy and boost inflation, the Bank of Japan decisively implemented unconventional monetary policies, including zero and negative interest rates. Consequently, although Japan's national debt has long surpassed the trillion-yen mark, the government still lives comfortably without any repayment pressure.

However, for the U.S., doing so presents a fatal problem.

As the sharpest weapon for the U.S. to harvest global wealth, the flexibility of the dollar tide is greatly reduced.

This topic was discussed in a previous article titled "China-U.S. Financial Game, but Japan Suffers," which essentially explains how the U.S. relies on strategies of raising and lowering interest rates to plunder the world's wealth. Here is a brief description of the specific steps:

When the global economy is relatively depressed or asset prices are low, the Federal Reserve will lower interest rates, increasing the supply of dollars, reducing the cost of capital, and thus stimulating borrowing and consumption by businesses and individuals. At this time, the dollar's liquidity is enhanced, and it begins to flow to various parts of the world in search of investment opportunities.In this context, let's assume there is an American car manufacturer facing a decline in sales and a backlog of inventory.

When the Federal Reserve announces a rate cut, the supply of dollars will increase immediately, and the cost of capital will also decrease accordingly. The manufacturer can take advantage of this opportunity right away to significantly boost car sales by lowering car prices and offering preferential loans, among other measures.

At the same time, the manufacturer can also use the low-cost financing of the dollar to search globally for high-quality automotive manufacturing assets or brands for acquisition. Due to the global economic downturn, the prices of these assets or brands are relatively low, allowing the manufacturer to complete the acquisition at a lower cost.

Next comes the recovery and growth of the global economy, during which asset prices begin to rise and inflationary pressures increase. The Federal Reserve will raise interest rates to curb inflation and prevent the economy from overheating. The rate hike leads to a reduction in the supply of dollars, an increase in the cost of capital, and the dollar begins to flow back to the United States.

In this context, the value of the overseas assets or brands previously acquired by the manufacturer also increases accordingly.

After the Federal Reserve announces a rate hike, the dollar flows back to the United States, increasing the global demand for the dollar. The manufacturer can quickly sell these already appreciated overseas assets or brands, thus making a substantial profit from the difference.

At the same time, the manufacturer can also take advantage of the appreciation of the dollar during the rate hike period, converting the sales income from overseas markets into dollars and flowing back to the United States, thereby reaping a significant amount of dollar reserves.

This is the specific way in which the dollar tide harvests the world's wealth.

However, since interest rates are not allowed to be raised for a long time, the rate hike strategy of the dollar tide will inevitably be greatly limited, which is the biggest crisis for U.S. debt.

Of course, the United States has many other means of making money, such as shorting the stock market, military hegemony, and economic sanctions, but these are essentially taking other people's money to fatten itself. There are no real fools in this world; it's just that the United States is currently the sole superpower, and it's simply too much to bear being fleeced. As long as there is a future day, even if there is only the slightest opportunity to pry open hegemony, there will surely be a collective attack.After all, on what basis does he always enjoy the tranquility of time while letting others bear the burden and move forward.

Leave a Comment