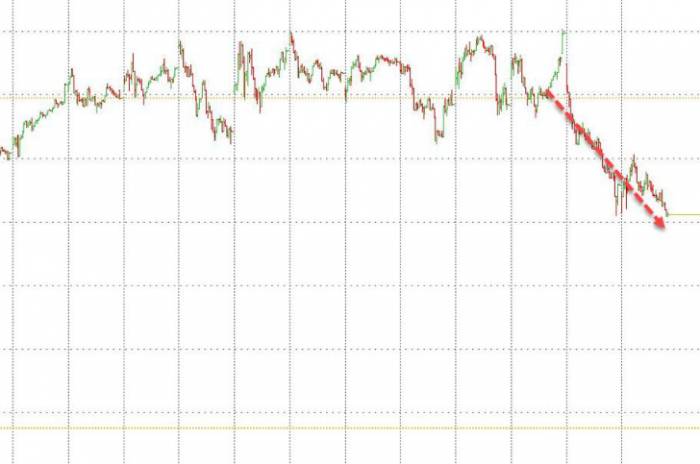

On September 5th, following the resumption of trading, Guoxin Securities (002736.SZ) continued to decline, with a drop exceeding 5%.

On the evening of September 4th, Guoxin Securities made new progress in its acquisition of Wanhe Securities. Guoxin Securities released a preliminary plan for the issuance of shares to purchase assets and related transactions (hereinafter referred to as the "transaction plan"). The company intends to purchase 96.08% of the shares held by seven shareholders of Wanhe Securities through the issuance of A-shares. At the same time, Guoxin Securities resumed trading on September 5th from the market opening.

These seven shareholders are respectively, Shenzhen Capital Operation Group Co., Ltd. (hereinafter referred to as "Shenzhen Capital", 53.09%), Shenzhen Kunpeng Equity Investment Co., Ltd. (hereinafter referred to as "Kunpeng Investment", 24%), Shum Yip Group Co., Ltd. (hereinafter referred to as "Shum Yip Group", 7.58%), Shenzhen Innovation Investment Group Co., Ltd. (hereinafter referred to as "Shenzhen Innovation", 3.44%), Shenzhen Yuanfu Zhi Fu Hai No. 10 Investment Enterprise (Limited Partnership) (hereinafter referred to as "Yuanfu Zhi Fu Hai No. 10", 3.30%), Chengdu Jiaozi Financial Holding Group Co., Ltd. (hereinafter referred to as "Chengdu Jiaozi", 3.22%), and Haikou Financial Holding Group Co., Ltd. (hereinafter referred to as "Haikou Financial", 1.45%).

In fact, Wanhe Securities has a total of 8 shareholders, and the one that did not participate in this merger and acquisition is Shenzhen State-owned Equity Management Co., Ltd., which holds 3.92% of the shares of Wanhe Securities.

Regarding the lock-up period, the shares of the listed company subscribed by the target assets in this share issuance to purchase assets shall not be transferred within 12 months from the date of completion of the new share issuance of the asset purchase; however, transfers permitted by applicable laws are not subject to this restriction.

On August 21st, Guoxin Securities announced that it was planning to issue shares to purchase the assets of Wanhe Securities. The share acquisition ratio disclosed this time has significantly increased compared to the last time. At that time, Guoxin Securities planned to merge and acquire more than 50% of the shares of Wanhe Securities, and the preliminary determined transaction counterparty for the share issuance to purchase assets was Shenzhen Capital, which held 53.09% of the total shares of the target company.

Public information shows that on January 18, 2002, Wanhe Securities Brokerage Co., Ltd. was registered and established in Haikou City, Hainan Province, and in July 2016, the company completed the shareholding reform and changed to Wanhe Securities Co., Ltd. After multiple capital increases and share expansions from 2014 to 2017, the company's current registered capital is 2.273 billion yuan, the controlling shareholder is Shenzhen Capital Group, the actual controller is the Shenzhen Municipal State-owned Assets Supervision and Administration Commission, and the legal representative is Gan Weibin.

According to the data disclosed in the transaction plan, as of June 30th, Wanhe Securities' revenue was 180 million yuan, the net profit was -17.4237 million yuan, and the total assets were 11.331 billion yuan.

According to the current transaction plan, after the completion of this transaction, the controlling shareholder of Guoxin Securities will still be Shenzhen Investment Holdings, and the actual controller will still be the Shenzhen Municipal State-owned Assets Supervision and Administration Commission. This transaction will not result in a change of control of the listed company.As of now, Shenzhen Investment Holdings (SZIH) holds 33.53% of the shares in Guoxin Securities, making it the controlling shareholder of the brokerage firm. The State-owned Assets Supervision and Administration Commission of Shenzhen Municipality (SASAC) holds 100% of SZIH's equity, thus being the actual controller. SZIH also holds 49% of the shares in China Resources Shenzhen International Trust Co., Ltd., the second-largest shareholder of Guoxin Securities.

According to the specific plan for the purchase of assets by issuing shares, the issue price for this transaction is set at 8.6 yuan per share. This price is not lower than 80% of the average trading price of the listed company's stock in the 60 trading days before the pricing benchmark date, and it is not lower than the per-share net asset value attributable to the shareholders of the listed company as of the latest period (December 31, 2023), which has been audited.

The transaction plan indicates that after the completion of this transaction, Wanhe Securities will become a subsidiary of Guoxin Securities. Guoxin Securities can fully utilize local policy advantages and existing business resources from both parties to achieve rapid development in international business and financial innovation business, and to realize the joint development of cross-border business and existing business.

According to the preliminary statistical ranking by the China Securities Association for 145 securities companies in 2023, Wanhe Securities ranks 85th in total assets, 84th in net assets, 84th in net capital, 100th in operating income, and 99th in net profit.

As per the official website of Wanhe Securities, the brokerage currently has 27 branches and 25 business departments, forming a network layout centered on the Greater Bay Area, focusing on the Pearl River Delta and Yangtze River Delta regions, and radiating throughout the country.

Donghai Securities analysis suggests that the acquisition of Wanhe Securities by Guoxin Securities may have a limited impact on performance enhancement. "Wanhe Securities has experienced significant fluctuations in net profits in recent years, with profits of 340 million yuan in 2021, losses of 210 million yuan in 2022, and a slight profit of 58.75 million yuan in 2023. We believe this is mainly affected by the volatility of proprietary business operations. The proportion of proprietary income (sum of investment income and fair value changes in profit and loss / operating income) for 2021-2023 was 78%, -18%, and 57%, respectively, indicating that market fluctuations have a significant impact on the company's performance."

Furthermore, the transaction plan shows that since the audit work related to this transaction has not been completed, the financial data of the target company has not been finally determined. Therefore, the changes in the main financial indicators of the listed company before and after this transaction cannot be accurately quantified at this time. The transaction is expected not to meet the standards for significant asset restructuring as stipulated by the "Regulations on Mergers and Acquisitions."

Donghai Securities believes that since the Central Financial Work Conference proposed the construction of first-class investment banks, the wave of market-oriented mergers and acquisitions has continued to emerge. In the early stages of mergers and acquisitions, the market mostly promotes the perfection of the territory with the purpose of business or regional complementarity, and is committed to making up for the shortcomings in investment banking, asset management, brokerage network, and other business areas. For example, Guolian Securities' acquisition of Minsheng Securities, Zheshang Securities' acquisition of Guodu Securities, and Western Securities' acquisition of Guorong Securities. The integration of business and regions is conducive to achieving broader market coverage, expanding market share, and enhancing overall competitiveness.

It is worth noting that at this stage, the integration of the state-owned capital system has been put on the agenda. Jinlong Shares also previously announced that it would transfer 20% of the equity of Dongguan Securities to the Dongguan consortium. After the completion, the Dongguan SASAC system will become the largest shareholder and control nearly 80%. "The equity integration within the state-owned capital system has been put on the agenda. By integrating licenses within the system, resources can be concentrated for business empowerment, improving capital operation efficiency and license value. At the same time, the net capital after integration is more abundant, and the business development under the classified evaluation and supervision system is expected to open up a new pattern." Donghai Securities elaborates in this way.

Leave a Comment