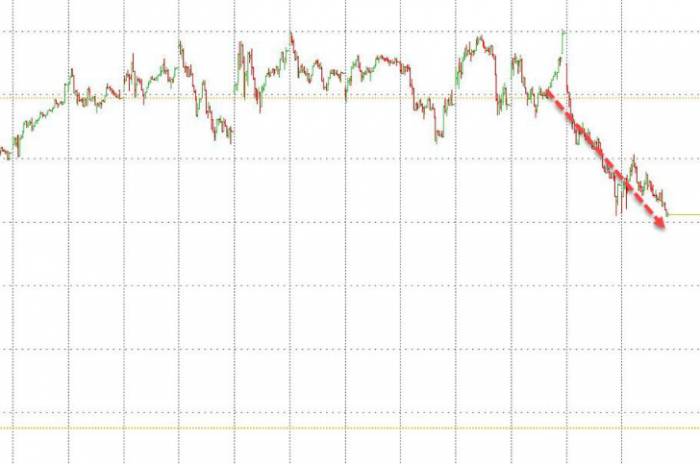

Asian stocks plummeted on Wednesday, hit by weak U.S. manufacturing data and renewed concerns about the overheating of artificial intelligence. The Nikkei 225 index fell by 4.2%, and the South Korean Kospi index dropped by 3.2%, marking their largest single-day declines since August 6th.

Just like the "Black Monday" on August 5th, the culprit triggering this Asian stock market crash was once again U.S. economic data. The Institute for Supply Management (ISM) announced on the 3rd that the U.S. Manufacturing Purchasing Managers' Index (PMI) for August was 47.2, slightly rebounding from the 11-month low of 46.8 set in July, but still below market expectations. Earlier that day, data from S&P Global showed that the U.S. August Markit manufacturing PMI final value was 47.9, lower than the expected and previous 48.

Tech giant Nvidia also "added fuel to the fire." According to a Bloomberg report on Tuesday, the U.S. Department of Justice issued subpoenas to Nvidia and other companies, seeking evidence of the chipmaker's violation of antitrust laws. Affected by this news, coupled with market concerns about the potential overheating of generative AI, Nvidia's stock price plummeted by 9.5% on Tuesday, with a single-day market value loss of $279 billion, which in turn affected other tech stocks and led to a collective decline in the three major U.S. stock indices, with the Nasdaq index falling by more than 3%.

Analysts believe that after the sharp decline, global stock markets may be in a volatile trend in the short term, and the U.S. August employment report to be released on Friday will become the focus of the market. The July non-farm data released early last month, which was significantly below expectations, led to a "Black Monday" in the global market. However, most analysts believe that the July employment data was affected by temporary factors such as extreme weather and does not indicate that the U.S. economy is about to fall into a recession.

As the Federal Reserve's September interest rate meeting approaches, the August non-farm employment report will largely determine the magnitude of the Fed's first interest rate cut in four and a half years.

Two weeks ago, Federal Reserve Chairman Jerome Powell said at the annual Jackson Hole conference that the time for policy adjustment has come. "The labor market has cooled significantly from its previous overheated state. The unemployment rate began to rise more than a year ago and is currently at 4.3%, which is still very low by historical standards but almost one percentage point higher than the level at the beginning of 2023," he said. "We do not want and do not welcome further cooling of the labor market."

Phil Camporeale, Portfolio Manager of Global Allocation Strategy at J.P. Morgan Asset Management, believes that whether the Fed will cut interest rates by 25 or 50 basis points in September largely depends on the August non-farm employment report.

Citibank also believes that the August non-farm employment data will largely determine the magnitude of the interest rate cut in September. According to Citi's forecast, the U.S. only added 125,000 jobs in August, far below the market expectation of 165,000, and the unemployment rate remained unchanged from the previous month at 4.3%.

Analysts pointed out that although interest rate cuts are usually beneficial to the stock market, this is not usually the case when the Fed is eager to prevent an economic recession.

J.P. Morgan strategist Mislav Matejka pointed out that given market sentiment, the path of interest rate cuts, and uncertainties in the U.S. elections and geopolitical aspects, coupled with September being a traditional off-season for U.S. stocks, "we are not out of the woods yet." He stated that even if the Fed starts the much-anticipated interest rate cut cycle, the stock market rally may stall near historical highs. Because any policy easing will be a response to slowing economic growth, it is therefore a "passive" interest rate cut.Additionally, many analysts believe that the U.S. stock market may have already peaked, with limited room for significant increases. Bank of America's "contrarian sentiment indicator" shows that in August, Wall Street's optimism towards stocks rose to a two-and-a-half-year high, which also implies that the market may be overheating and there is a risk of a downturn.

UBS points out that under the influence of high valuations in the U.S. stock market, the overall valuation of global stock markets is also high. In a report sent to clients on Monday, UBS stated that despite the stock market disaster at the beginning of the month, global stocks still rose by 1.9% in August, with a total return of 17% so far this year. Compared to historical levels, the current market's price-to-earnings ratio is at a higher level.

China Merchants Securities also believes that several factors make it "very difficult" for the U.S. stock market to continue to soar. First, inflation constrains the Federal Reserve's room for maneuver; second, Federal Reserve rate cuts will weaken the U.S. stock market's siphoning effect, and overseas investors also have the demand to take profits before the election; third, the key to the yen carry trade is the U.S. economy, as long as the U.S. economy continues to slow down, the yen carry trade may reverse again and exacerbate global market volatility; fourth, looking at the political cycle of the U.S. stock market, after the new president takes office, there will be at least one year of adjustment pressure in 2025-26.

However, some analysts are more optimistic, believing that it is possible to buy on dips. Callie Cox, Chief Market Strategist at Ritholtz Wealth Management in New York, told Bloomberg that there are many reasons to be optimistic, such as the growth in earnings of U.S. companies, the Federal Reserve is about to start easing policy under the background of controlled inflation, and investors have a lot of cash on hand, "which may be reinvested in the stock market."

Leave a Comment