01

Regarding the notion of speculative fortune-changing, Koreans are undoubtedly the landslide in the East Asian circle.

According to a report on cryptocurrency business activities released by the Korean Financial Intelligence Unit, by the end of 2023, the number of active users on registered exchanges in South Korea increased by 390,000, with the total number of cryptocurrency traders surpassing 6.45 million.

It should be noted that the total population of South Korea is just over 51 million, which means that one out of every ten people is trading cryptocurrencies, with the vast majority being individual investors, predominantly aged between 30 and 40.

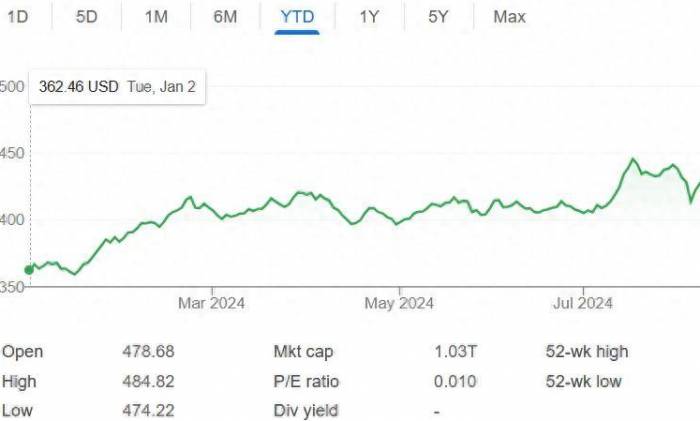

The report also indicates that over the past year, the average daily trading volume of cryptocurrencies in South Korea has grown by 24%, reaching nearly 3.6 trillion won, equivalent to 2.6 billion US dollars, while the total market value of cryptocurrencies held by registered exchanges has soared by 53%, already amounting to 440 trillion won.

In the first quarter of this year, the South Korean won dethroned the US dollar to become the currency with the largest global trading volume in cryptocurrency assets, with Upbit joining the ranks of the top five global cryptocurrency exchanges.

The data suggests that South Koreans are serious about the attitude towards getting rich overnight. After a nationwide stock craze, collective real estate speculation, and endless lottery scratching, the land of kimchi has once again embarked on a frenzied cryptocurrency trading mode, with countless young people standing on the rooftop of dreams once more.

In fact, as early as 2017, 20% of the global Bitcoin transactions were already taking place in South Korea. At its peak, the selling price of Bitcoin in South Korea was even 20%-40% higher than the international market.

Such a high premium, of course, is not because South Koreans have any insights into "blockchain" or "decentralization"; the only thing they care about is how to trade cryptocurrencies to turn their fortunes around and make a substantial profit before immediately stopping.In the circle, there is a special term called "graduation."

However, those who can graduate are as rare as phoenix feathers and qilin horns, while those who lose money and are broken in defense, or even jump into the river, are everywhere.

In June 2021, South Korea exposed a Ponzi scheme version of the coin circle, with 70,000 people being deceived of nearly 4 trillion won, equivalent to 22.1 billion yuan, many of whom were retired elderly who didn't even understand the term.

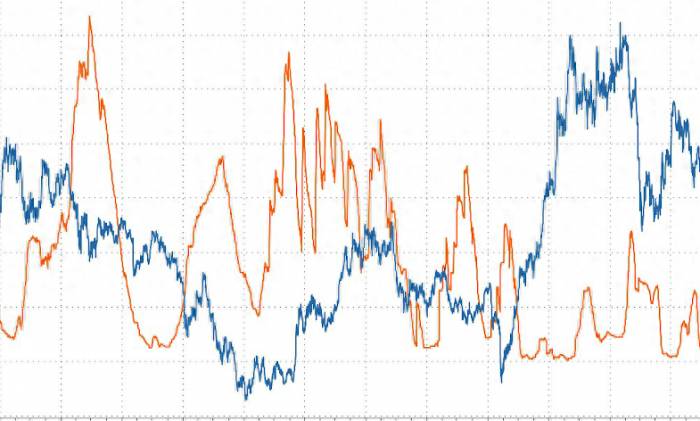

In May 2022, the so-called "Moutai of the coin circle" Luna coin plummeted, and in less than a month, the market value fell from 119 US dollars to less than 0.0002 US dollars per coin, and more than 200,000 South Koreans lost their money, and the number of people searching for "Mapo Bridge" online formed a long queue.

This Mapo Bridge is the place for South Koreans to jump into the river.

02

The painful memories have not passed for a year, and South Koreans are standing on the roof of the coin speculation again.

So the question arises, why do South Koreans still send people to the coin circle with the continuous swing of the sickle?

In fact, South Koreans are not only obsessed with cryptocurrencies, but also with stock speculation, real estate speculation, and lottery scratching, as long as it is related to speculation, it can trigger the collective pursuit of this country.

According to media reports, as early as 2021, the number of active stock accounts in South Korea exceeded 60 million, which is 10 million more than the total population.Among South Korean stockholders of Samsung Electronics, there are 350,000 who are under 20 years old, and even elementary school students can be seen at the annual shareholders' meetings.

In 2021, the sales amount of lottery tickets in South Korea approached 600 billion won, equivalent to 31.9 billion yuan in RMB, with an industry compound annual growth rate close to 10%. Approximately 61.8% of South Koreans buy lottery tickets at least once a year.

A popular saying in the South Korean workplace is that one should always have two pieces of paper at work: one is a lottery ticket, and the other is a resignation letter.

Young people are mainly focused on getting rich overnight, while the middle class plays a game of hot potato.

Last year, the eggshell apartment scandal in South Korea essentially involved landlords using tenants' deposits to speculate in real estate. However, when banks raised interest rates, it led to a funding breakdown, and many landlords fled due to their inability to return the deposits. In the end, it was still the young people who couldn't get their deposits back.

Behind all the frantic speculation is a rather helpless reality.

This is because the class solidification in South Korean society has become very severe, and speculation is the only way for young people to change their destiny against the odds.

In fact, since the outbreak of the 1997 Asian financial crisis, South Korean society no longer believes in the beautiful myth of "getting rich through hard work."

Due to the United States' control over South Korea's financial system and the economic lifelines of many core enterprises, South Korea has reluctantly shifted to a new normal of slow income growth and extremely unstable job positions, not much better than the situation across the sea.

It is in this broader context that South Korean society has prematurely experienced the triple effects of infertility, aging, and extreme widening of wealth disparity.There's a humorous saying online that goes, "Without Seoul, South Korea would be half-dead."

Although it's a bit of an exaggeration, the situation is indeed somewhat like that.

South Korea has a population of 50 million, with nearly half living in the Seoul economic circle. Almost all of the country's major industries, from finance to mobile phones, and from automobiles to shipbuilding, have their headquarters located here without exception.

Seoul covers an area of only 605 square kilometers, accounting for just 0.6% of South Korea's total area, yet it has a population of nearly ten million, and its economic output represents 21% of the nation's total.

The housing prices in Seoul exceed 150,000 RMB per square meter, and in the affluent Gangnam district, they even surpass 350,000 RMB.

For most young people, if they weren't born in Seoul, they would have to finish their education and then tackle the hellish challenge of Seoul's housing prices.

Those who can't keep up either choose to lie flat or take a gamble in the stock market or cryptocurrency circles.

The rise of mega urban areas naturally exacerbates the hollowing out of other cities, followed by an over-concentration of wealth, and the gap between the rich and the poor in society is widening more and more.

Currently, the top 10% of South Korea's wealthy possess 60% of the country's total income, 20% of families hold 98.6% of the real estate, and the income of affluent families is astonishingly 1400 times that of ordinary families.Conglomerates like Samsung, LG, and Hyundai account for up to 80% of a nation's economic output, yet they provide less than 10% of the job market, leaving the majority of young people to eke out a living in small and medium-sized enterprises with meager salaries and highly unstable jobs.

In 2023, the average annual salary for a South Korean is about 220,000 RMB, which translates to roughly 18,000 RMB per month when spread over 12 months. In contrast, the average wages in Shanghai and Beijing are around 13,000 RMB, with Shenzhen slightly lower but still reaching 12,000 RMB.

But do you realize how outrageous the cost of living in South Korea is?

According to data released by South Korean media, in April of this year, the price of dining out in South Korea rose by 3% year-on-year, while the cost of agricultural products surged by 20.3%. Even dishes like tteokbokki (spicy rice cakes) and kimchi fried rice increased by 5%.

In supermarkets, the price of cherry tomatoes is equivalent to 57 RMB per kilogram, 1.2 kilograms of beef costs 528 RMB, 10 kilograms of rice is 153 RMB, and 9 kilograms of apples are 290 RMB; 3 kilograms of potatoes are 62 RMB.

This means that while South Koreans earn about 40% more than their counterparts in Beijing, Shanghai, Guangzhou, and Shenzhen, the cost of living is two to four times higher.

So when a "soil spoon" realizes that despite working tirelessly and enduring long hours, their annual income is less than a third of a "gold spoon's" monthly salary, with wages stagnant while housing and living costs skyrocket, all their efforts seem meaningless.

This desperate survival reality has driven South Korean youth to two extremes.

Some have started to pursue ultimate stability; if they can't join big corporations as workhorses, they study furiously to take civil service exams. In South Korea, civil servants are also known as "God's workplace," an absolute "iron rice bowl."

The other group has mostly chosen to gamble with their lives. Data shows that over 60% of South Koreans harbor dreams of getting rich quick through stocks, lotteries, and cryptocurrency trading, and the number of investors in South Korea has surpassed 20% of the national population.In this country where wealth is excessively concentrated and housing prices are outrageously high, speculation might be the lifestyle that comes closest for Koreans to defy the heavens and change their destiny.

Although the probability is very low and can be considered negligible, more and more Koreans are choosing to take a desperate gamble. If they cannot soar to the skies, all that's left is to be shattered into pieces.

The templates may vary, but the trend is consistent.

When society locks up the channels for upward mobility, young people can only choose to lie flat or bet their entire lives.

Leave a Comment