Over the past three years, Tianqi Lithium has lost 80% of its value, with a market capitalization evaporation of approximately 200 billion yuan.

Recently, Tianqi Lithium (002466.SZ) announced its semi-annual report. According to the announcement, Tianqi Lithium's operating income was 6.419 billion yuan, a year-on-year decrease of 74.14%; it reported a net loss of 5.206 billion yuan, compared to a net profit of 6.45 billion yuan in the same period last year. Clearly, Tianqi Lithium is facing a severe crisis.

Some might argue that, looking solely at the second quarter, Tianqi Lithium's net loss was 1.3 billion yuan, which is a significant narrowing compared to the first quarter, thus suggesting that a turning point in performance has arrived.

Is this really the case?

Not so optimistic!

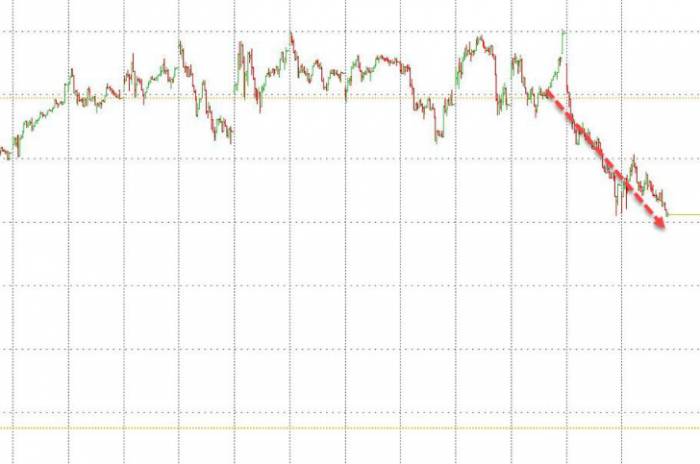

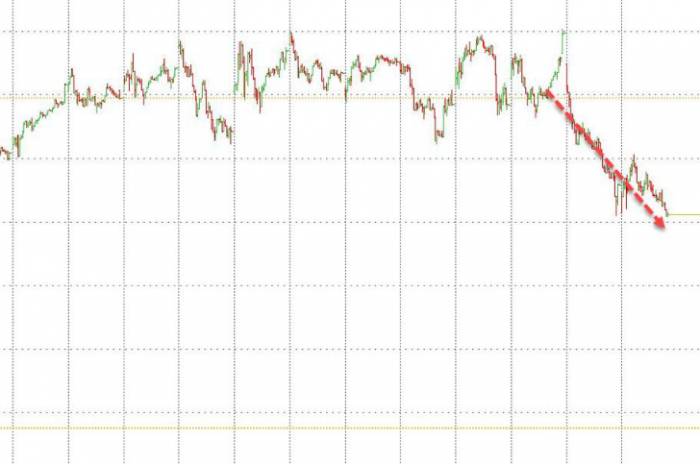

In March of this year, the price of lithium carbonate rebounded to 120,000 yuan/ton, but after entering the second quarter, the price of lithium carbonate continued to fall. In the second quarter of this year, the price of lithium carbonate dropped from 120,000 yuan to 90,000 yuan; however, by the end of August, this figure had fallen to around 70,000 yuan/ton.

This means that, judging from the price trend of lithium carbonate, the situation in the third quarter could be even worse!

So, is the once "Lithium King" Tianqi Lithium truly doomed to sink forever?

In fact, the company's current stock price has already reflected this expectation.

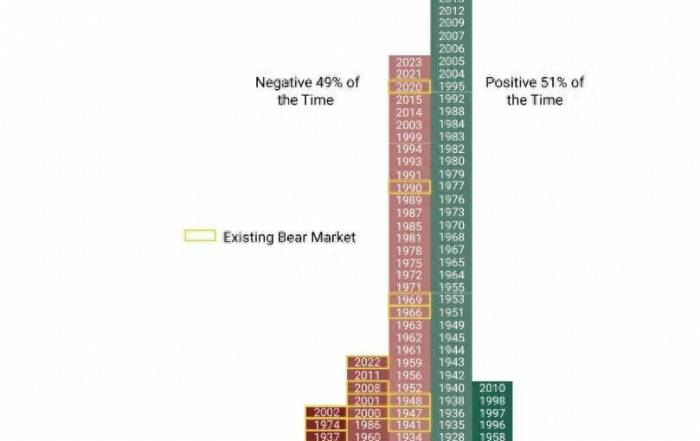

Over the past three years, Tianqi Lithium's stock price has plummeted from a high of 144.22 yuan to around 25 yuan, with a drop of over 80%, and the market value has lost about 200 billion yuan. This decline has far exceeded the average decline of the lithium battery sector, and Tianqi Lithium's price-to-book ratio is now less than 1.Speaking of which, Tianqi Lithium has a history filled with legendary tales. The predecessor of Tianqi Lithium, Tianqi Group, initially engaged in the business of mineral imports. In 2004, Tianqi Group acquired the Sichuan Shehong Lithium Salt Plant, officially entering the lithium mining industry. It's worth noting that prior to the acquisition, the Shehong Lithium Salt Plant suffered from consecutive years of losses and was insolvent, but after being acquired by Tianqi Group, it managed to turn profitable within just two years.

Following that, Tianqi Lithium embarked on an aggressive path of mergers and acquisitions. The boldest acquisition took place in 2018 when Tianqi Lithium purchased 23.77% of SQM's shares for $4.066 billion. It's important to note that at that time, Tianqi Lithium only had 5.5 billion yuan in cash on hand. To complete this "David and Goliath" acquisition, Tianqi Lithium took on a massive debt, and coupled with the low prices of lithium carbonate, the company's cash flow was nearly broken.

As everyone knows, with the skyrocketing price of lithium carbonate, Tianqi Lithium transformed into the "Lithium King." In 2022, Tianqi Lithium's net profit reached 24.12 billion yuan, and its debt ratio significantly dropped from 82.32% to 25%.

Therefore, for Tianqi Lithium, despite the current situation being very challenging, it is by no means as bad as it was in 2019. After all, Tianqi Lithium now has nearly ten billion yuan in cash on its books.

However, the days ahead for Tianqi Lithium are indeed not optimistic.

Hongye Futures believes that in the short term, the lithium carbonate market is in the peak season, with demand gradually being realized, providing some support for prices. But the long-term outlook for supply and demand is pessimistic, which may limit further price increases. The Chilean Copper Commission's forecast is even more straightforward, predicting that the global lithium market will be in surplus in 2024 and 2025, with the oversupply situation only easing in 2026.

The reasons are not hard to understand. Firstly, globally, lithium resources are not scarce. Secondly, after the significant increase in lithium carbonate prices in 2021 and 2022, countries such as Argentina, Chile, and Australia, including domestic sources, are accelerating lithium mining, leading to a substantial increase in production capacity. Furthermore, unlike oil, lithium carbonate can be recycled, which means that the global stock of lithium carbonate will only continue to grow.In a single sentence, despite the burgeoning nature of industries such as new energy vehicles and energy storage, the increase in demand cannot keep pace with the rapid expansion of production capacity.

Of course, there are also reasons for optimism.

Energy metals are part of a cyclical industry that requires meticulous management. In the first half of 2024, even though the price of lithium carbonate remained around 100,000 yuan/ton, Tianqi Lithium's gross margin was still as high as 51.81%, significantly higher than that of its peers. From this perspective, relying on production capacity and cost advantages, coupled with refined operations, Tianqi Lithium can also achieve stable returns. However, it should be noted that the extravagant wealth of the past is gone and will not return.

Let me add one more point.

According to the semi-annual report, Tianqi Lithium's associated company SQM is facing tax disputes, which led Tianqi Lithium to recognize approximately $1.1 billion in income tax expenses, thereby affecting the company's net profit. Additionally, Tianqi Lithium is embroiled in a revenue distribution issue with Codelco, the Chilean state copper company. Starting from 2031, Codelco's share of the operating profits from SQM will rise to 85%.

This represents a significant setback for Tianqi Lithium in its overseas expansion, and it is also a challenge that all Chinese companies venturing abroad may encounter. On this issue, we need to conduct a profound reflection.

Leave a Comment