The primary factor currently influencing the flow of international capital is the Federal Reserve's interest rate cut policy that is expected to come in September.

From the current market expectations, it seems almost certain that the Federal Reserve will cut interest rates for the first time in September. When the U.S. monetary policy enters a rate-cutting cycle, the world's mainstream assets tend to experience greater fluctuations than usual.

In this video, we will review how the stock market fluctuated during previous instances when the Federal Reserve entered its first rate cut, and use this to assess what opportunities the current rate cut by the Federal Reserve might bring us.

1. How did the market fluctuate after past rate cuts?

Since 1982, the Federal Reserve has gone through six interest rate cut cycles.

The most recent one was on July 31, 2019. Looking back at the U.S. stock market trend around that time (as shown in the figure), before the rate cut, the market experienced a downward adjustment in May. Subsequently, as the timing of the rate cut became closer and the first rate cut became more certain, the market saw a period of upward movement. However, when the rate cut actually arrived, with short-term expectations being realized, the market entered another phase of downward adjustment. After the rate cut, the adjustment lasted for two months, and in early October, the market touched bottom for the second time before starting to rise again. This rate cut lasted for a total of 8 months, with a reduction of 225 basis points. Later, the COVID-19 pandemic led to a significant downward shift in the Federal Reserve's monetary policy in a short period. Excluding the impact of the unexpected events during the COVID-19 pandemic, the stock market generally showed an upward trend during this rate cut cycle.

The previous one was on September 18, 2007. This was different from 2019, as before this rate cut, the U.S. had maintained a high-interest policy for a long time, and the economy had already shown signs of recession in the data. The rate cut was introduced to loosen the economic constraints. On the day of the rate cut, the Nasdaq rose by 2.7%. However, before the rate cut, due to the emergence of the economic recession expectation, the market had experienced a downward adjustment from mid-July to mid-August 2007, with a drop of 10%. It then turned upward because the overall trend of the U.S. stock market was still upward at this stage. Even with the recession expectation, the market still showed a trend before and after the rate cut. However, in the following three months, after a brief upward movement, the market entered a sideways trend, and then, due to the continuous worsening of the economic recession, the market began a significant decline. This rate cut lasted for 15 months, with a reduction of 500 basis points. The rate cut was very large and the time was very short, mainly because the economy was experiencing a relatively serious recession at that time. During this rate cut cycle, the market showed a downward trend.

From the two rate cut periods mentioned earlier, we can see that rate cuts do affect the short-term trend of the market, but over a slightly longer period, it is still the original market and economic trends that dominate.

Next, let's look at the rate cut cycle on January 3, 2001. This was similar to the subprime crisis, as the background was during the burst of the internet bubble, and the entire market was pessimistic about internet technology companies, with the market already in a downward trend. So when the market announced a rate cut on January 3, 2001, the market rose by 14.17% in a single day and then experienced a slight stabilization and upward movement in the following month. However, the market then returned to its original downward trend (as shown in the figure). This rate cut lasted for 30 months, with a reduction of 550 basis points, in order to alleviate the impact of the burst of the internet bubble.From the three interest rate cutting cycles, we can temporarily observe that the market changes before and after the actual occurrence of interest rate cuts are more closely related to two factors.

The first point is the original market trend. If the economy was already in recession and the market began to enter a downward phase, even the occurrence of interest rate cuts could not change the overall trend. If the original economy and market were relatively healthy, then no matter how the market fluctuated, it would eventually rise.

The second point is that the impact of interest rate cuts on expectations at the time is crucial. In the 2019 interest rate cut, it was a preemptive measure against economic recession. Therefore, before the actual interest rate cut, the positive expectations of the cut had already begun to ferment continuously, and the market rose. When the interest rate cut actually took place, the expectations were realized, and the market fell and adjusted for a while. In addition, the two instances in 2007 and 2001 were relief-type interest rate cuts. The economic recession or market downturn had already occurred, and the sudden interest rate cut was to alleviate the recession. Therefore, each time an interest rate cut appeared, it was beyond the original market expectations, and the market would experience a brief stabilization and rise.

Now, with these tentative conclusions, let's look further ahead.

Looking further ahead, we come to July 6, 1995. The context at the time was that the United States was in a period of continuous fermentation of internet technology. The interest rate hike in 1994 was to prevent the economy from overheating, and it was done quite hastily. After a round of interest rate hikes, the economic growth in the United States clearly slowed down, and the PMI once fell to the "boom-or-bust line." To prevent the economy from entering a recession, an immediate announcement of an interest rate cut was made on July 6, 1995. In fact, before the interest rate cut, the market had been rising, and with the overall upward trend, the market rose even faster with the addition of the interest rate cut benefits (as shown in the figure). This interest rate cut lasted for 40 months, from July 6, 1995, continuing on and off until November 17, 1998, with a reduction of 125 basis points. The process of this interest rate cutting cycle was indeed slow, and there was even a brief interest rate hike in the middle. However, this did not prevent the Nasdaq market from being in a super bull market during this period.

So far, we believe that the points summarized above can actually be nested within the interest rate cutting cycle. However, let's look further back.

The previous one was on June 6, 1989, when the interest rate cut was mainly to address the economic recession in the United States caused by the savings and loan crisis. The interest rate cutting cycle began, and we look at the trend of the Nasdaq (as shown in the figure). There was some fluctuation before and after the interest rate cut, and even a period of pullback after the cut, but it eventually returned to the original upward trend.

Going further back, we have the interest rate cutting cycle of 1984.

In fact, on October 19, 1987, the U.S. stock market, led by the Dow Jones, experienced a brief crash (as shown in the figure). To prevent the pessimistic sentiment brought by "Black Monday" from spreading to the economy, the Federal Reserve also made a sudden interest rate cut, which lasted only three months and had a small reduction of 81 basis points. Later, the stock market also returned to its original trend. The 1987 interest rate cut was small, short, and sudden, so we do not consider it within the term "interest rate cutting cycle."

On September 20, 1984, to prevent exchange rate fluctuations caused by high deficits and a strong dollar from affecting the economy, the Federal Reserve implemented an interest rate cut, which lasted for 23 months with a reduction of 560 basis points. At this time, the U.S. market was still mainly dominated by the Dow Jones. However, whether it was the Dow Jones or the Nasdaq, the trend was similar. Before the interest rate cut, due to the expectation of a recession, the market had already fallen and adjusted in advance. Then, as the time approached the interest rate cut, it rose, and when the interest rate cut actually came, the market expectations were realized, and there was another wave of nearly two and a half months of fluctuation and adjustment. Afterward, because the recession did not come, the market returned to its original upward trend (as shown in the figure).Reflecting on history, we can gain some insights. To understand the present, it is essential to first comprehend the impact of interest rate cuts on market expectations this time around, as well as the current economic and market trends.

II. How should we view market volatility following this round of interest rate cuts?

Comparing with the past, the purpose of entering the interest rate cut cycle this time is quite similar to that of 1984, 1995, and 2019, all aimed at preventing economic recessions. There are some patterns in market fluctuations before and after these three interest rate cuts. In 1984 and 2019, the markets initially fell when recession expectations emerged, then rebounded due to the anticipation of interest rate cuts, only to enter another period of decline and adjustment after the cuts were implemented. However, both times, after a two-month adjustment, the markets returned to their original upward trend. The 1995 instance was somewhat different; despite the presence of recession expectations, the market was in such a strong position that there was almost no correction during the two months before and after the rate cut, and it kept rising.

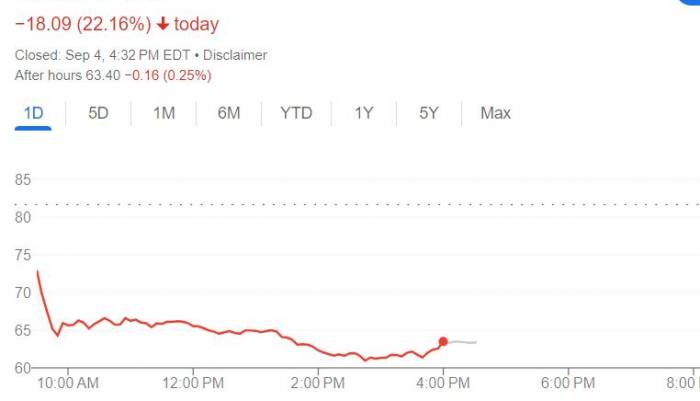

Looking back at the onset of this interest rate cut cycle, the market had already experienced a decline due to expectations of economic recession, which was the period from July 11th to August 5th. Subsequently, the market anticipated an interest rate cut in September, and this positive outlook led to a rebound in the market (as shown in the figure). As of today, which is August 23rd, 2024, Beijing time, the interest rate cut has not yet occurred, and the market expects the first cut to happen at the early September meeting.

If we were to extrapolate from historical patterns, should the market indeed experience an interest rate cut as expected in early September, and it is the anticipated 25 basis points, the market may very well undergo another period of decline and adjustment due to the short-term realization of expectations. If the cut exceeds 25 basis points, beyond the current market expectations, the market could continue to rise for a while. However, if there is no interest rate cut in early September, a market decline is highly likely.

Of course, this is a pattern we have deduced from historical phenomena and applied to the onset of this interest rate cut cycle. However, from the conclusions we have drawn, the market is more likely to experience a short-term decline and adjustment after the first interest rate cut in September.

Nevertheless, when we consider the economic and market trends, the U.S. economy has not shown any clear signs of recession, and the trend in the capital market continues to be upward. Therefore, we believe that even if the market adjusts after this round of interest rate cuts, it is more probable that it will continue in the previous direction.

Conclusion:History is not a mere repetition, but with each occurrence, there are some similar phenomena.

Everything today is a reenactment of history, and the law of time is cyclical.

Leave a Comment